A bill that began life as a requirement that CalPERS and CalSTRS divest holdings in Dakota Access Pipeline firms emerged from a legislative committee last week reborn — a requirement that the pension funds only report on their “engagement” with the firms.

The revised AB 20 by Assemblyman Ash Kalra, D-San Jose, reflects a new emphasis on what the two big state pension funds say is often a less costly and more effective alternative to divestment: remaining a shareholder with a “seat at the table” to advocate change.

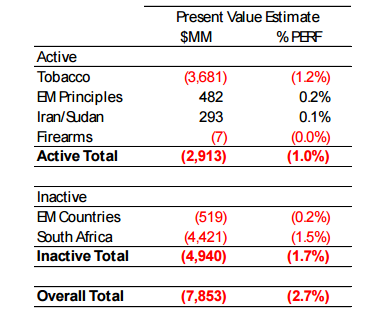

Since the sale of investments in firms doing business with apartheid South Africa in 1986, all CalPERS divestments have resulted in a total loss of $7.9 billion, including transaction costs and foregone investment returns, Wilshire consultants estimated earlier this year.

The two state pension funds, still struggling to recover from huge investment losses a decade ago, are taking a harder look at a small wave of divestment bills proposed by legislators on a wide range of political issues.

Both pension funds recently were about 64 percent funded, CalPERS as of last January and CalSTRS last June. Most of their employer contribution rates are doubling over a decade or less, squeezing local government and school budgets.

Experts predict that investment earnings, expected to pay nearly two-thirds of future pension costs, will weaken after a long bull market. Both pension funds recently dropped their investment earnings forecast from an annual average of 7.5 percent to 7 percent.

The small wave of divestment bills followed Gov. Brown’s signature two years ago on a bill by Senate President Pro Tempore Kevin de Leon, D-Los Angeles, requiring divestment, if fiduciarily responsible, of thermal coal companies not transitioning to clean energy.

Last year three bills that failed passage required pension fund divestment of any holdings in securitized home rental properties, banned additional investments in firms that further the boycott of Israel, and prohibited investments in Turkey government bonds.

This year, in addition to the pipeline, there are divestment bills on firms building a Mexican border wall and Turkey government bonds and a bill requiring the two pension funds to consider financial climate risk in the management of their funds.

Critics say divestment limits investment opportunity, decreases diversification, burdens staff, and may limit returns, increase risk, and result only in a turnover of shares with little or no effect on the target.

A union-sponsored constitutional amendment (Proposition 162 in 1992), a response to a legislative “raid” on pension funds, made paying benefits the top pension board priority, up from equal standing with minimizing employer contributions and reasonable administrative costs.

“A retirement board’s duty to its participants and their beneficiaries shall take precedence over any other duty,” said the amendment. Arguably, the two state pension boards could legally decline to divest, citing net losses and their fiduciary duty to pensioners.

“The Legislature may by statute continue to prohibit certain investments by a retirement board where it is in the public interest to do so, and provided that the prohibition satisfies the standards of fiduciary care and loyalty required of a retirement board pursuant to this section,” said the amendment.

A revised investment policy adopted by the CalPERS board last week in a second reading drew opposition during public comment from RL Miller, president of Climate Hawks Vote and the elected chair of the California Democratic Party’s environmental caucus.

Miller said the divestment policy can be summed up as “no divestment ever.” The policy said divestment “appears to almost invariably harm investment performance” and often is a mere transfer of ownership that only results in a loss of influence on the company.

“This Policy, therefore, generally prohibits Divesting in response to Divestment Initiatives, but permits CalPERS to use constructive engagement, where consistent with fiduciary duties, to help Divestment Initiatives achieve their goals,” the policy said.

Despite hearing in February from dozens urging Dakota pipeline divestment, Miller said, the only CalPERS response was a letter urging Energy Transfer Partners to reroute the pipeline, then 90 percent complete and only weeks away from moving oil through Sioux sacred land.

And despite a Democratic Party resolution in 2015 urging the California Public Employees Retirement System and the California State Teachers Retirement System to divest fossil fuel, she said, two of the largest CalPERS holdings are in Exxon and Chevron.

“You are deliberately choosing to shun the single most effective tool in an engaged shareholder’s tool box, divestment,” Miller said at a CalPERS investment committee meeting. (See CalPERS video, remarks begin at 1:14)

State Controller Betty Yee, who sits on the CalPERS and CalSTRS boards, told Miller she thinks the policy encourages engagement but is not an outright ban on divestment, which should be considered on a case-by-case basis.

“We are fiduciaries of this fund,” Yee said. “Our sole focus is how we are going to pay the benefits that our public-sector workers and educators have earned during their career, and it’s becoming a tougher business to be in as you heard this morning.”

People listen when CalPERS (investments valued at $317.5 billion last week) speaks, Yee said, but it lacks clout to make change on its own and does much engagement with other large investors. She said some work is not reported in documents that might reveal strategy.

“But understand, we are not letting up on this,” Yee said. “We also see the risk, the huge risk that climate is going to place on this fund relative to the ability of companies to continue to create long-term value.”

The CalSTRS board discussed divestment early this month while taking an “oppose unless amended” position on three bills. A forum to help legislators better understand work already being done was mentioned as a way to slow the introduction of divestment bills.

CalPERS did not take a position on the divestment bills. Kalra said he was influenced by the CalPERS and CalSTRS advocacy of engagement as he told the Assembly public pension committee his Dakota pipeline measure was no longer a divestment bill.

A bill requiring divestment of companies that build President Trump’s Mexican border wall was rescheduled for a hearing in the Assembly committee on May 3, an author of AB 946, Assemblywoman Lorena Gonzalez Fletcher, D-San Diego, said in a news release.

The committee approved a bill requiring divestment of Turkey bonds for failure to recognize the Aremenian genocide. The author, Adrin Nazarian, D-Van Nuys, said AB 1597 would only take effect if the federal government acts first.

Today, the Senate pension committee is scheduled to hear a bill requiring the two pension funds to consider climate risk in fund management and to make annual reports of climate risk in their investment portfolios, SB 560 by Sen. Ben Allen, D-Santa Monica.

[divider] [/divider]