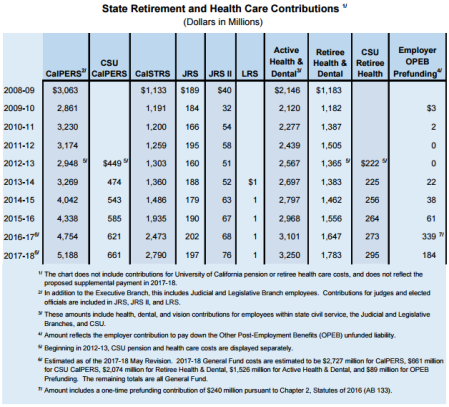

The payment to CalPERS for state worker pensions next year would double under a revised state budget proposed by Gov. Brown yesterday, going from nearly $6 billion to a total of about $12 billion.

If all goes as planned the extra $6 billion payment, borrowed from a state cash-flow fund, is estimated to save the state $11 billion over the next two decades by more rapidly paying down pension debt.

The California Public Employees Retirement System has been encouraging local governments, if they are able, to pay more than the required annual amount to save money in the long run.

About 15 percent of the local governments in CalPERS have contributed more than the required annual payment for their debt or “unfunded liability” in the last five years, a CalPERS spokeswoman, Amy Morgan, said yesterday.

As of last June, the CalPERS state worker plans only had 65 percent of the projected assets needed to pay future pensions. The debt, $59.6 billion, is mainly the result of investment earnings that were below the forecast, recently lowered from an average of 7.5 to 7 percent.

Brown had repeatedly urged the independent CalPERS board to lower its investment earnings forecast, a painful change that requires employers to increase contributions to fill the funding gap that presumably had been filled by earnings.

The governor joined with state Treasurer John Chiang, a member of the CalPERS board, in a plan to borrow $6 billion from the state Surplus Money Investment Fund, managed by the treasurer but separate from a similar local government fund.

Surplus money from numerous state funds is pooled and invested until it’s needed. To remain ready to return cash on demand, the fund said to be worth $50 billion is in short-term investments earning about 1 percent.

The $6 billion additional payment to CalPERS is expected, like other long-term pension fund investments, to earn 7 percent over the next two decades.

“Given that CalPERS has averaged an investment return of nearly 7 percent over the past 20 years, the additional interest earnings generated by the mega-payment represents a win-win for state workers and taxpayers,” Chiang said in a news release.

“For every dollar we will put in today, the unfunded liability will be reduced by $2 over the next 20 years,” he said.

State payments to CalPERS in the new fiscal year beginning July 1 are expected to be $5.8 billion, said the governor’s Finance department, growing to $9.2 billion by fiscal 2023-24. The extra $6 billion is expected to drop the payment to $8.6 billion in 2023.

If investments average 7 percent earnings and other assumptions remain unchanged, the extra $6 billion payment is expected to lower the state CalPERS contribution rate an average of 2.1 percent of pay below the current schedule.

For example, Finance said, in about five years “peak rates would drop from 38.4 percent to 35.7 percent for State Miscellaneous (non-safety) workers, and peak rates would drop from 69 percent to 63.9 percent for CHP officers.”

The $6 billion extra state payment to CalPERS potentially could be made in three or four installments next fiscal year, said a Finance fact sheet outlining the proposed supplemental pension payment.

Roughly half of the $6 billion loan, covering general fund costs, would be repaid by the Proposition 2 “rainy day” fund approved by voters in 2014 that can only be used to pay long-term debt.

The rest of the loan would be repaid by a number of state restricted special funds that can only be used for one purpose, such as transportation.

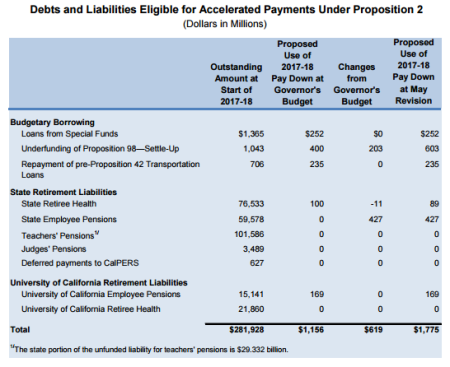

The chart shows a $427 million Proposition 2 payment to CalPERS next fiscal year for state worker pensions, the first installment. The plan is to pay off the loan as soon as possible but no later than 2030.

The Finance fact sheet also said the extra pension payment will not affect AB 55 infrastructure loans from the Surplus Money Investment Fund, which has about $50 billion in its investment portfolio.

State budgetary borrowing during the lean years is expected to be paid off in a few years, said the fact sheet, leaving “ample room” within the Proposition 2 requirement to repay the general fund portion of the extra pension payment.

Funds available to cover the cash-flow gap between tax receipts and spending during a fiscal year have been “historically high,” said the fact sheet. But if there is a severe economic downturn, the state can resume external borrowing, as happened in the past even in good years.

At a news conference yesterday, Michael Cohen, Brown’s Finance director, was asked about the risk of a large CalPERS investment loss after the state makes the $6 billion extra payment.

Quarterly payments would provide some time to react to a market change, Cohen said. But retirement systems are long-term investors with an investment strategy over 20 to 30 years.

“Yes, it’s possible that the stock market takes a nose dive in year two or three,” Cohen said. “But we have, like I say, another 17 years to make the money back.

“Compared to the cash-flow earnings that we are making now, we have a lot of margin for error. Even if they only gain 5 percent over the next 20 years, we would still be about 4 percent ahead.”

The Finance chart (above) on Proposition 2 payments shows the state has a long-term debt of $282 billion, nearly all from retirement unfunded liability.

“These retirement liabilities have grown by $51 billion in the last year alone due to poor investment returns and the adoption of more realistic assumptions about future earnings,” said the Finance revised budget proposal.

The California State Teachers Retirement System has a much larger unfunded liability, $101.6 billion, than the CalPERS state worker plans. The nonpartisan Legislative Analyst’s Office suggested last week that the Proposition 2 fund could be used to reduce the CalSTRS debt.

But the chart footnote saying the state share of the CalSTRS unfunded liability is $29.3 billion suggests Finance continues to believe most of the debt obligation remains with school districts and teachers.

The chart also shows the debt for retiree health care promised state workers, $76.5 billion, is larger than the state worker CalPERS pension debt, $59.6 billion. Similarly, the UC retiree health care debt, $21.9 billion, is greater than the UC pension debt, $15.1 billion.

[divider] [/divider]