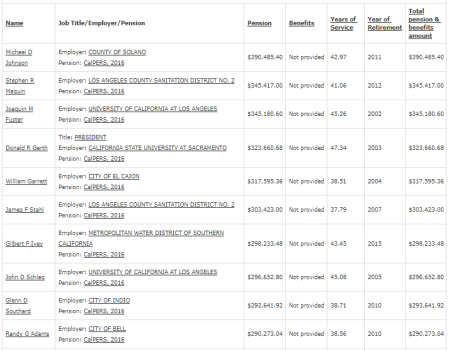

If the Internal Revenue Service annual limit for a public pension was $210,000 two years ago, why were the top 10 CalPERS pensions well above the limit, ranging from $290,273 to $390,485?

The answer is that pension systems have the option of going over the IRS limit — if they set up a special fund so only the employer pays the cost of the “excess” pension amount.

A “qualified governmental excess benefit arrangement” allowed under federal tax law, IRC section 415(m), has been set up by each of the state pension systems: CalPERS, CalSTRS, and the UC Retirement System.

The number of CalPERS retirees receiving “excess benefit” payments, 978 as of last June, is growing. But under a reform capping pensions for employees hired after Jan. 1, 2013, the excess payments are expected, over the decades, to begin declining and eventually end.

Last month, the CalPERS board rejected a proposal that might have made excess benefit collection more difficult. As part of a drive to reduce the complexity of the system, CalPERS would identify pensions over the IRS limit but no longer make the payment.

“Employers would need to establish processes to pay excess benefits, taxes, generate annual tax forms, and provide customer service to participants,” said a staff report.

A staff review of “peer public pension systems” found that several administer excess payments like the California Public Employees Retirement System. Others contract with a bank to make the payments or do not allow pensions that exceed the IRS limit.

A look at eliminating the excess benefit program was requested by outgoing board member J.J. Jelincic. He did not run for re-election, after two four-year terms, and the December board meeting was his last one.

“I get tired of hearing of the people who are getting $300,000 pensions,” said Jelincic, “and I know that part of that is this excess pension.”

In response to his question, Jelincic was told that CalPERS probably could, when receiving a public records act request, report a $300,000 pension as $220,000 from CalPERS (the IRS limit this year) and $80,000 from the employer.

“Now Transparent California is probably going to combine the two because they’ve got their own agenda,” he said. “But we ought to be pushing our agenda, which basically is to expose what real pensions are to real employees.”

Transparent California, a government watchdog that says it has made public record requests to more than 2,500 government agencies, maintains a large database of the pay and pensions of state and local goverment employees on a website searchable by the public.

The CalPERS board voted to “maintain the status quo.” Elimination of the excess benefit program, opposed by county and school groups, was said to be too burdensome for employers with small staffs and retirees with more than one employer.

CalPERS charges employers a 2 percent fee that covers the cost of the program. Payments totaled $20.6 million last year. The average annual excess benefit payment was about $20,000 a year, ranging from about $240 to $120,000 a year.

The IRS limit is intended to prevent public pensions from becoming tax shelters. Under federal law, taxes are deferred on contributions to a pension fund, and its investment earnings, until the money is received by the member or a beneficiary

In a well-publicized excess, a Vernon city official, Bruce Malkenhorst, received a $551,668 pension. Finding that hidden pay increases boosted the amount, CalPERS cut his pension and began an attempt in 2015 to recover $3.4 million. His pension in 2016: $124,212.

Robert Rizzo, one of a half dozen Bell city officials convicted in an inflated-pay scheme, was said by some to be on the way to a combined $1 million pension before he was sentenced in 2014 to 12 years in prison. His CalPERS pension in 2016 was $87,112.

Randy Adams, briefly Bell police chief, had his requested pension cut by half. His salary jumped from $235,000 as Glendale chief to $457,000 at Bell, causing Glendale and three other former employers to pay much of the inflated pension cost. His 2016 pension: $290,273.

As part of the pension reform that took effect five years ago, CalPERS is working on regulations to ensure that an employer creating a significant pension liability, like Bell, pays the increased cost, said Tara Gallegos, CalPERS spokeswoman.

The standard CalPERS IRS pension limit increased from $215,000 to $220,000 this year for persons age 62 and above. But for those who retire earlier the limit is actuarially reduced, dropping to about $97,000 at age 50.

A fifth of the nearly 1,000 CalPERS retirees receiving excess payments are correctional officers, the CalPERS board was told. They have the same pension formula as police and firefighters, 3 percent of final pay for each year served at age 50.

But correctional officers aren’t classified as “safety” like police police and firefighters, who have the age 62 limit. So, a correctional officer pension of more than $97,000 might trigger an excess payment, while a police pension might not until reaching $220,000.

The California State Teachers Retirement System has an excess benefits program with a lower IRS limit than CalPERS. The CalSTRS program also is expected to eventually end as ineligible post-reform hires replace earlier employees.

Excess benefit payments were being paid to 351 CalSTRS recipients as of Jan. 1, said Michelle Mussoto, CalSTRS spokeswoman. The average annual payment was about $31,825 last year, ranging from about $1,213 to $156,108.

The CalSTRS IRS limit last year was $183,781 at age 65. It’s lower than the CalPERS limit last year, $215,000 at age 65, because of complicated “return of contributions provisions” and a 2 percent cost-of-living adjustment based on the initial pension amount.

CalSTRS top 10 pensions in 2016 ranged from $422,239 to $288,712. But the top pension, $422,239 for Dennis Bailey of Eastside Union High School in the San Jose area, is a one-time amount.

Bailey retired in 2016 with an effective date in 2012 when he stopped earning pay that increased his pension, CalSTRS said. He received four years of retroactive payments for a pension that is now about $87,000 a year.

The UC Retirement System has an IRS limit similar to CalPERS, $220,000 this year. Though not covered by the reform legislation that took effect five years ago, UC adopted a similar cap expected to keep new hires under the IRS limit, even over a long career.

Excess benefit payments totaling $16.9 million were received by 500 UC retirees last fiscal year, said Dianne Klein, UC spokeswoman. The average annual payment was about $33,744, ranging from about $502 to $232,379.

Top 10 CalSTRS pensions in 2016 listed on Transparent California

[divider] [/divider]