Americans are unhappy with state and federal government in general. The topic of taxes would seem to trigger intense voter backlash.

However, cities, counties and special districts considering placing new revenue measures on the ballot in 2012 could by surprised by a receptive electorate. California voters largely support local tax increases and local elected officials often face little Election Day consequence for voting to raise them.

Seventy-five percent of ballot measures to increase, revise, expand or extend local taxes, fees or bonds passed in the November 2011 California elections. Voters are clearly willing to impose new taxes on themselves.

This reflects a distinction between local and statewide realities. Regional revenue measures stand a significantly better chance of success at the polls than do statewide measures. The public’s dissatisfaction with, and distrust of, California state government does not typically extend to local and regional government agencies.

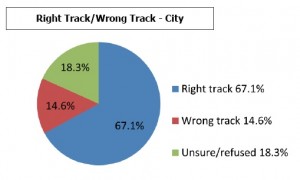

Voters tend to think of their city or community as generally being on the right track (with the occasional “City of Bell” exception). This contrasts starkly with majority who generally feel that the nation is on the wrong track (and in many states – California in particular – that their state is on the wrong track).

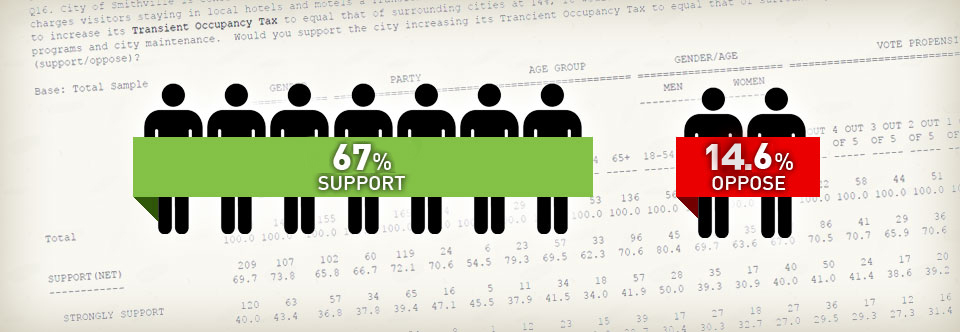

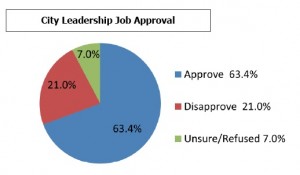

The following example is taken from a recent survey we conducted on behalf of a medium-sized Southern Californian city. Two-thirds of voters feel their city is on the right track, and 63% approved of the job that their mayor and city council is doing:

Voters are considerably more likely to (1) be content with their community and invested in its future (2) regard their local government leadership as credible and therefore (3) be more receptive to a local agency or elected officials as a messenger.

The key persuader for voter receptivity to local taxes? Knowing that new revenues are protected from “cash-grabs” by Sacramento.

All this does not mean that passing new taxes is a cakewalk. Thirteen out of the 53 local revenue measures on the November 2011 ballot failed. Our research shows that for local revenue measures to succeed, voters need to achieve comfort in several key areas:

- There must be a pressing need for the money such as dilapidated roads or the threat of severe cutbacks like library or park closures or public safety layoffs.

- Alternatives such as seeking grants, internal cost savings and concessions from labor have been exhausted.

- Proper oversight will insure that the new revenue will be spent as promised. We encourage citizen oversight committees and full spending transparency on a unique and easy to read web site.

- The agency’s existing funds are being well managed and the budget is sustainable.

Adam Probolsky is chairman and CEO of Probolsky Research LLC, a full service opinion research organization based in Newport Beach, California serving government, corporate and special interest clients.