Originally posted at CalPensions.

By Ed Mendel.

Chances of the Stockton bankruptcy producing a landmark ruling to cut pensions dimmed last week, when the city announced a deal with one bond insurer and a tentative deal with another one.

The two big bond insurers, who unsuccessfully opposed Stockton’s eligibility for bankruptcy, argued that a city plan to cut bond debt was unfair because the largest creditor, CalPERS, would be untouched.

U.S. Bankruptcy Judge Christopher Klein said the proper time to rule on the CalPERS question is when the court considers whether all creditors are being treated fairly by the city “plan of adjustment” to cut debt and emerge from bankruptcy.

Now Stockton may be taking big steps toward resolving the fairness issue by negotiating a plan with creditors to exit bankruptcy as urged by the judge. Klein brought in another bankruptcy judge, Elizabeth Perris, to conduct mediation.

A debt-cutting plan proposed by Stockton last week cited a tentative agreement with National Public Finance Guarantee, backer of $89 million in bonds, and a draft agreement awaiting approval by Assured Guarantee, backing $164 million in bonds.

The Stockton city manager, Bob Deis, said the city has agreements with 14 of 19 major creditors. He said a “cram down” approach, which imposes debt cuts opposed by creditors, will not occur until a court order is obtained.

Deis said the proposed plan of adjustment, scheduled for a City Council vote Thursday, is the first step in a complicated process that could, in six months, get Stockton out of the bankruptcy declared June 28 last year.

“While we expect further intense negotiations and court hearings, with perhaps a set back here and there before this is over, this at least is the beginning of the end,” Deis wrote in the plan. “It provides the final piece in our road back to putting our financial house in order.”

One of the remaining hurdles is getting voter approval of a ¾-cent sales tax on Nov. 5. The plan said the alternative to Measure A is $11 million in additional “brutal” spending cuts and the loss of “negotiating room to cut deals with our creditors.”

The Stockton bankruptcy has been widely watched because of speculation that public pensions, protected against cuts by state court decisions based on contract law, might be reduced in federal bankruptcy court like other contract debt.

If the city negotiates agreements that avoid a ruling on whether pensions can be cut, the Stockton bankruptcy still may have produced an important ruling on a growing retirement cost: retiree health care promised state and local government workers.

Retiree health care often has a long-term debt or “unfunded liability” similar to pensions. But most employers do not make annual pension-like contributions to a retiree health fund, which can yield investment earnings to help pay future costs.

The view that retiree health care is a benefit that can be cut may change. This month a superior court overturned a freeze on retiree health care for Los Angeles city attorneys, citing the same contract case law that protects public pensions.

The new Los Angeles ruling, though limited and likely to be appealed, is already having an impact.

“Court ruling on retiree health benefits credit negative for Los Angeles, could impact other California municipalities,” said a headline in a Wall Street credit rating agency newsletter last week, Moody’s Weekly Credit Outlook for Sept. 26.

If it turns out that state law does indeed give promised retiree health care the same protection as pensions, a ruling in the Stockton bankruptcy could be important as desperate cities look at the option of bankruptcy.

Judge Klein, in a deeply researched 40-page ruling last year, refused to temporarily block Stockton’s elimination of retiree health care while the city pursued eligibility for bankruptcy (granted in April) and a debt-reduction plan to exit bankruptcy.

A Stockton retiree group argued that their promised retiree health care is a vested right under federal and state contract law. Under federal law, Klein said, a bankruptcy court cannot “interfere with” the property or revenue of a debtor.

In other words, the bankruptcy court cannot tell the debtor how to spend its money. So Klein said he could not block the cut that “may lead to tragic hardships for individuals in the interval before their claims are redressed” in a plan of adjustment.

The elimination of retiree health care for current workers and retirees is one of the major savings in the proposed Stockton plan of adjustment released last week.

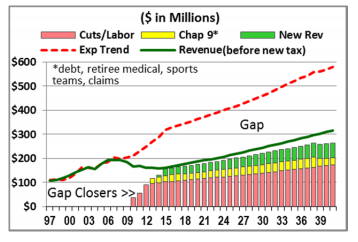

“When I arrived in July, 2010, the unfunded actuarial accrued liability (for retiree health care) was $544 million,” Deis wrote. “By comparison, the actuarial value of unfunded liability for the California Public Employees Retirement System (CalPERS) for June 30, 2011, was $172 million.”

Stockton has said since filing for bankruptcy that it does not want to cut CalPERS debt, arguing that pensions must be protected to keep the crime-ridden city competitive in the job marketplace, particularly for police.

Last June the city announced an agreement with a retiree group for a $5.1 million retiree health care lump sum payment for an estimated 1,100 retiree claims, up from an original proposal that would have given them nothing.

The proposed plan said Stockton has two groups of retirees, divided by a big increase in benefits adopted by many local governments after a CalPERS-sponsored bill, SB 400 in 1999, gave state workers a large, trendsetting retroactive pension increase.

Workers who retired before Stockton gave employees a benefit increase early last decade have an average pension of $24,000 and no retiree health care. Since the increase, the average pension is $51,000 (most get no Social Security) with a medical benefit worth $26,000 a year.

Stockton has negotiated agreements with all of its labor unions. The plan estimated that the loss of retiree health care, pension reforms and pay cuts reduces the total retirement benefit for current workers by 30 percent to 50 percent or more.

Current employees will pay the full employee share of the contribution to the California Public Employees Retirement System, 7 to 9 percent of pay. New employees get a lower pension under a state reform.

If Stockton can cut a deal with the bond insurers, the judge may not have to determine whether the bond insurers are treated unfairly because the cuts for Stockton retirees are not deep enough.

A tough opening position by Stockton has softened in negotiations. The new plan said that under a deal in February, Ambac, backer of $12 million in bonds, gets revenue from property tax growth and will not get a “haircut” if assessed values grow as expected.

National Public gets revenue from property tax growth that should “fully service” a restructured deal on $45 million in arena bonds. New parking revenue is expected to cover a deal on $32 million in bonds for three garages, repossessed by National Public.

The draft deal with Assured for $124 million in unsecured pension bonds and $40 million in bonds for a city hall building, repossessed by Assured, await approval by Assured executives and were not revealed.