Last week was not a good one for CalPERS, which carefully tracks mentions of the giant pension system in the media and gives each story a rating of positive, neutral or negative.

Wednesday, Gov. Brown said CalPERS adopted regulations that undermine the anti-spiking provisions for new hires in his pension reform. He directed his staff to determine what actions can be taken to protect the legislation enacted two years ago.

Thursday, the state Fair Practices Political Commission rejected a proposed $1,000 fine for CalPERS board member Priya Mathur, suggesting a $4,000 fine for a serial offender who has repeatedly failed to file campaign funding reports.

A major CalPERS increase in employer costs is under way for several reasons, including big investment losses during the recession. But for a decade, CalPERS has been under fire from critics, who say it’s an “unsustainable” drain on government services.

Former Gov. Arnold Schwarzenegger briefly backed a proposal early in 2005 to switch all new state and local government hires to 401(k)-style individual investment plans, which avoid long-term government debt but switch investment risk to employees.

Schwarzenegger dropped the proposal after being hit with a union-backed statewide television campaign attacking him and the proposal, one of the first setbacks of his administration. But for CalPERS the threat remains.

A statewide poll issued last January by the nonpartisan Public Policy Institute of California found, as in previous polls, strong support for switching new government hires to a 401(k) plan, 73 percent of likely voters with majorities in both parties.

The question about switching to a 401(k) plan was preceded by another question about whether public pensions are a state and local government budget problem, getting even stronger support, 85 percent of likely voters.

Beyond cost, another potential problem for CalPERS, a fiduciary entrusted with protecting member benefits, is the issue of inequality. The private sector continues to switch to 401(k) plans, which critics say are risky for retirees and often inadequate.

Some don’t even have 401(k) plans. A Federal Reserve report issued early this month said “one in five people who are near retirement have zero money saved,” the Washington Post reported.

The California Public Employees Retirement System is a rare state agency that faces a continuing cloud over its existence. While working to improve services and control costs, CalPERS keeps an eye on movement that, one way or another, might begin to phase it out.

So, it’s probably no surprise that in an annual report on the CalPERS five-year strategic plan issued this month, two of the three listed goals mention “sustainability” in addition to cultivating a high-performing organization.

The report shows progress. Investments earned 18.4 percent last fiscal year, well above the 7.5 percent target. The funding level, after dropping to 61 percent in 2009, is now about 76 percent of the projected assets needed to pay promised pensions.

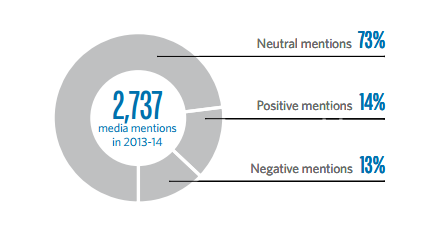

A small section on “our perception in the media” at the end of the annual report summarizes the monthly media reports to the board last fiscal year. Negative mentions were 13 percent of the total, down “significantly” from the previous year.

The governor objected to a CalPERS board decision, made last Apriland then put out for public comment before adoption last week, that allows temporary pay for short-term promotions to boost pensions.

“This disregards the rule that pensions will be based on normal monthly pay and not on short term, ad hoc pay increases,” Brown said in a letter to CalPERS about clarifying pay used to calculate pensions for new hires under his reform.

His aides said short-term promotions can be used to “spike” or improperly increase pensions. Unions argued that pensions are part of pay and some short-term promotions last a full year, the period often used to calculate pay for pensions.

The reform bill caps pensions earned by employees hired after Jan. 1 last year at the maximum wage taxed for Social Security ($117,000 this year) for members of CalPERS, the California State Teachers Retirement System and 20 county systems.

Some current annual pensions are far above the Social Security limit. Topping a pension reform group’s “$100,000 club” are a $371,000 CalPERS pension for a Solano County retiree and a $302,000 CalSTRS pensions for a Modesto elementary retiree.

Brown did not object to the CalPERS regulation allowing nearly 100 “extra pay” items to count toward pensions, many that sound like routine or marginal work. Much of the media criticism of the CalPERS regulations has focused on the extra pay items.

In the governor’s view, the extra pay items apparently were covered by the negotiated agreement on the reform bill, AB 340 in 2012. The pay items are part of “normal monthly pay” and are set by government employers, not CalPERS.

Mathur, elected to the CalPERS board in 2002, was fined $6,000 by the FPPC in 2006 for failing to file required campaign reports and a total of $7,000 in 2010 for similar offenses.

She was accused of ignoring repeated attempts by the FPPC to talk to her. The CalPERS board censured Mathur in 2010, temporarily removing her from the chairmanship of the health benefits committee and suspending her travel privileges.

“I feel we may be going in the wrong direction here,” Jodi Remke, the FPPC chairwoman, said last week. Remke noted the lower proposed fine, $1,000, and “numerous” staff attempts to get Mathur to file four missing reports for a two-year period.

Staff was told to come back with a higher fine, perhaps $1,000 for each count. Mathur had “zero activity” to report, said Gary Winuk, the FPPC enforcement chief, when a board member asked about the rationale for a $1,000 fine.

Mathur holds one of the six seats on the 13-member board filled in elections by active and retired CalPERS members. She has the support of two big unions, SEIU and AFSCME, but faces a challenge from Leyne Milstein, Sacramento finance director.

Milstein displayed her pension knowledge with a detailed presentation to the CalPERS board last January of the impact on Sacramento of a longevity rate hike, $12.2 million over five years, the equivalent of 102 full-time positions.

Mathur challenged the accuracy of Milstein’s candidate statement: “With recent CalPERS board decisions resulting in what could easily be 55 percent increases or greater in pension costs for more than 400 participating local agencies over the next six years …”

After reviewing a 367-page submission from Mathur and a 50-page document from Milstein, an administrative law judge, Jonathan Lew, ruled on July 29 that Milstein’s statement is not misleading.

“Candidate has provided substantial documentation based upon CalPERS published information, for her assertion …,” Lew said.

Three candidates are running for an open CalPERS board seat: Theresa Taylor, David Miller and Igbal Badwalz. The largest state worker union, SEIU Local 1000, is spending $180,000 on radio and online ads for Taylor, the Sacramento Bee reported last week.

The League of Women Voters is sponsoring a candidate forum from 5 to 6:30 p.m. Sept. 16 in the CalPERS auditorium, 400 P St.