By Nicholas Pinter, Rui Hui, and Kathy Schaefer.

Across the US and worldwide, flooding is the deadliest and most costly natural disaster. The US National Flood Insurance Program (NFIP) is an imperfect framework for reducing flood losses, but currently the best we’ve got. NFIP is scheduled for Congressional reauthorization in 2017, and this debate promises to be lively. The Natural Hazards Research and Mitigation Group at UC Davis has been analyzing NFIP databases, examining patterns over the history of the program and focusing on flood losses and flood insurance, particularly in California.

Over the history of NFIP, California is one of a few states that has – through dry years and wet – received only a small fraction of payments from NFIP compared to the premiums it has paid in. Since 1994, NFIP damage payouts in California have totaled just 14% of premiums collected (compared to 560% for the biggest recipient state, Mississippi). For California, this imbalance exceeds $3 billion (2015 dollars) over 21 years, funds that could have been invested in risk-reduction, floodplain management, and reduced premiums.

California has unparalleled expertise and a culture of progressive solutions for managing its flood risk; the state also has unique needs and intense pressures looking forward. With the US NFIP facing an uncertain future – >$20 billion in debt, and with a challenging Congressional reauthorization discussion looming in 2017 – we recommend a careful look at California’s place in the NFIP. In particular, California should now explore a state flood insurance program, with savings invested in long-term risk reduction. Properly implemented, a state-based insurance program and proactive flood mitigation strategies could synergistically benefit the environment, agriculture, recreation, and water resources. This approach has major challenges, with implications both for California and nationwide that should be explored.

Background

The National Flood Insurance Program (NFIP) was established in 1968 to curtail development on US floodplains and along our coasts. Until that time, homes and businesses were being built on flood-prone land almost without restraint. Flood damages were multiplying out of control, and private insurers had stopped offering flood coverage to homeowners and all but the largest businesses. As disastrous floods struck through the 1950s and 60s, victims had nowhere to turn but the federal government, and US taxpayers saw spiraling payouts for disaster relief. NFIP established a grand compromise – if communities would pass ordinances to limit new construction on floodplains and coastlines (and other activities that worsen flood damages), then the federal government would help provide flood insurance in those communities. Today NFIP underwrites over 5 million policies, providing over $1.25 trillion in coverage, taking in over $3.5 billion/year in premiums. NFIP has limited, but not halted floodplain development. But flood losses have continued to climb, and NFIP is now >$20 billion in debt.

We examined nationwide databases of NFIP flood-damage claims dating back to 1972, annual policies since 1994, and records of properties with multiple payouts (FEMA “severe repetitive loss” properties). These data include property characteristics, insurance claims, and the nature of flood losses. Some attributes were stripped from the databases to maintain policyholder anonymity. We combined NFIP data with other GIS information, such as income data and social vulnerability to examine affordability and equity of NFIP coverage.

California, Flood Risk, and the NFIP

Despite more than a century of investment in controlling flood threats, including $11 billion in flood management projects over the past decade (DWR, 2013), California still has massive flood-risk exposure. Statewide, roughly 7 million people and $580 billion in buildings, public infrastructure, and crops are at risk from flooding (DWR, 2013). Of 81 Major Disaster Declarations in the state since 1954, 45 involved flooding.

The Central Valley is the most flood-prone area of the State, a threat addressed during the past 100+ years by construction of levees, bypass channels, and upstream dams. In recent decades, developers and local officials have engaged in a tug-of-war with floodplain managers and flood-risk researchers, with local interests promoting new development on California’s floodplains behind levees, some of them strengthened and providing high levels of protection (others less). However, no levee provides complete protection – “There are two kinds of levees … [t]hose that have failed and those that will fail” (Martindale and Osman, 2010). Levee projects accompanied by additional floodplain development often increase total risk and flood liability (California Water Blog, July 17, 2016).

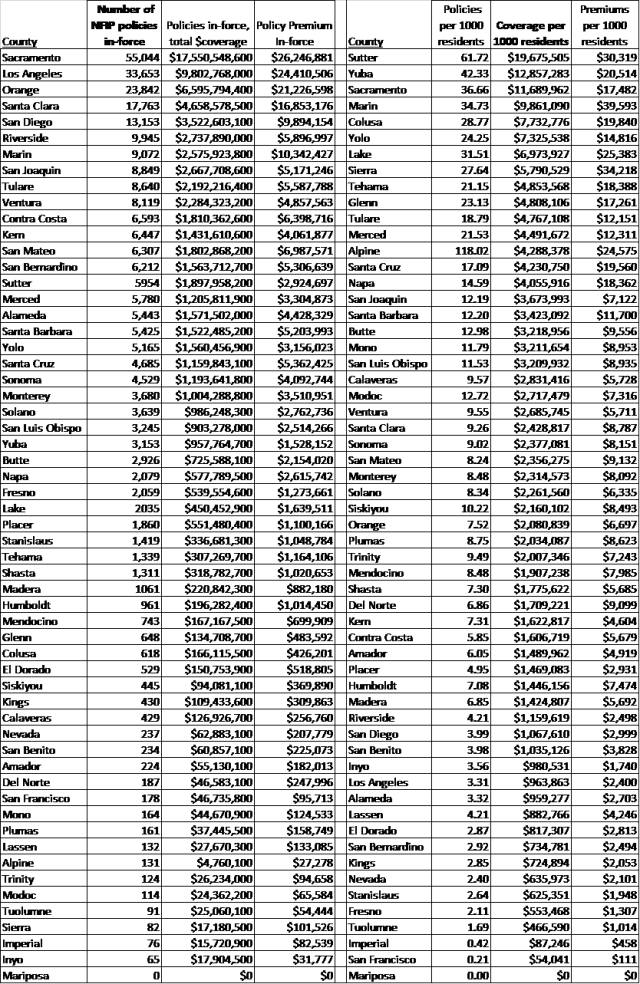

To counterbalance this threat, California has 290,000 NFIP policies in force, covering nearly $82.6 billion of insured assets, and generating $212.8 million in annual premiums (data to 10/31/2016). Table 1 shows the current distribution of NFIP insurance across California. These totals include residential, commercial, and some government properties on river floodplains and along coastlines. NFIP also insures properties outside of mapped flood-hazard zones, roughly one-third of all policies nationwide (Rand Corporation, 2006). The UC Davis analysis of the NFIP data is on-going, and interesting patterns are emerging in the California data and the full US dataset. Two conclusions have jumped out of the analyses completed to date that seem timely and pertinent to state and federal policy discussions.

Table 1. NFIP policies in California counties, as of 10/31/2016 , tabulated by total number of policies (left) and by total county insurance coverage (right).

Repetitive Losses

Thirty years after establishment of the NFIP, the Higher Ground report (NWF, 1998) singled out a problem –a small number of “repetitive loss” properties were receiving repeated insurance payouts, accounting for a disproportionate share of all NFIP outlays. At that time, just 2% of all insured properties drew 40% of all disaster payments. One property in Houston received 16 payouts totaling $806,591, more than seven times the structure’s value.

Our UC Davis research group, working with the Natural Resources Defense Council (NRDC), also looked at repetitive flood-loss properties. New FEMA data show that 30,369 properties (0.58% of NFIP policies) – designated “Severe Repetitive Loss” (SRL) properties – are responsible for 10.56% of all claims. (Our request to FEMA for its broader “Repetitive Loss” [RL] database is currently pending.) Current SRL properties include structures that have made up to 40 flood-damage claims each. One house in Alabama, valued at $153,000, has received $2.25 million in NFIP payouts – more than double the worst ratio in 1998 (the Houston property discussed above).

NRDC has proposed incentives to remove repetitive-loss properties from the NFIP insurance and the nation’s floodplains. Hayat and Moore (2015) propose “property owners should agree in advance not to rebuild following floods that cause substantial damage and, instead, to accept a government buyout of their property and relocate. In exchange, they would receive a discount on their federal flood insurance coverage….” We are now working to identify communities with repeated flood damages, high densities of designated SRL properties, and high socio-economic need (low income levels and/or high social vulnerability, Cutter et al., 2013). Implemented carefully, such proposals could reduce the most burdensome flood-loss properties, while improving insurance affordability and transitioning low-income residents off the floodplain.

Of >30,000 SRL properties nationwide, 393 are in California. At the top of the list, Louisiana has 7223 and Texas 4889 SRL properties. Nonetheless, the California SRL properties amount to $56.7 million in cumulative payments. More detailed examination suggests localized issues in California – Sonoma County ranks 20th among communities nationally for largest number of SRL claims (977) and 25th for total SRL payments ($27 million). The Sonoma County Hazard Mitigation Plan (Sonoma County, 2011; http://www.sonoma-county.org/prmd/docs/ hmp_2011/) acknowledges that “payments to Sonoma County for repetitive flood losses are greater than the next nine highest [California] communities combined and account for … 34% of total state dollar outlays.” California leads the nation in many metrics of flood protection and resilience, but local problem areas may require additional guidance, resources, and/or oversight.

NFIP Net Payers and Net Recipients

Flood insurance requires that many participants pay into the program in any given year so a few may draw funds in times of extreme need. Health, auto, and home insurance also may include low-risk participants who persistently pay into the program pooled with higher-risk participants. These variations are sometimes addressed by setting premiums proportional to estimated risk, but sometimes the risk factors are too difficult to quantify or are simply accepted as a subsidy to some in the insurance pool.

NFIP is rife with subsidies, such as low “grandfathered” premiums for homes in floodplain and coastal flood zones before the start of the program. Or repetitive-loss structures that resist attempts to mitigate or relocate off the floodplain. Our analyses of NFIP historical policy and claims data suggest that such imbalances and subsidies also exist at a state-to-state scale, and should be examined carefully.

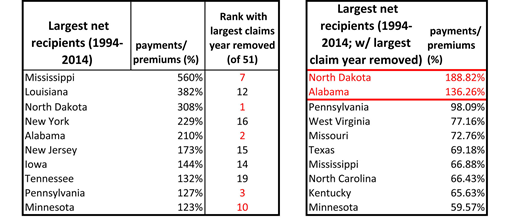

The UC Davis analysis examined 1994-2014 NFIP claims and premiums data. Calculated as ratios of total premiums paid to total claims, some US states emerged as long-term recipients of NFIP funds and other states as long-term payers into the program (Figure 1). Over these 21 years, Mississippi policyholders paid 18 cents per dollar of flood insurance pay-outs, whereas Wyoming policyholders paid $32 in premiums for every $1 in claims. The 10 largest net recipients of NFIP claims payments are tabulated (Table 2) as well as the 10 largest net “donor states” (Table 3).

Fig. 1. Ratios of claim payments to policy premiums during 1994-2014, by state (in 2015 dollars). Alaska, Hawaii, and US protectorates are not shown.

Among the top-ten recipients, several states show claims that largely result from a single flood event: Hurricane Katrina in 2005 for Louisiana, and Hurricane Sandy in 2012 for New York and New Jersey. Such catastrophic events are the nature of flooding – with average recurrence of damaging events spanning decades to centuries – and are the primary purpose of insurance. To consider the one-off effects of any particular flood event, we removed the year of greatest claims for each state, and re-ranked the resulting ratios (right side of Table 2). The resulting list, which includes North Dakota, Alabama, and Pennsylvania, captures states with more persistent patterns of flood damages and NFIP claims.

Table 3 tabulates the 10 states with the lowest total flood-damage claims calculated proportional to the premiums those states paid into NFIP. Also shown (Table 3, right) are the 10 states with the largest dollar differential between claims and premiums. In both cases in Table 3, the effect of removing the largest claims year for each state was minimal.

Table 2. Largest net recipients of NFIP flood payouts, calculated proportional to cumulative premiums by state. Also shown are the largest net recipients with the year of greatest flood year removed for each state.

Table 3. Largest net payers into NFIP, calculated as the ratio of cumulative payouts to premiums (left) and as a net dollar differential between payouts and premiums (right).

Implications

A major policy question is whether “net payer” states have just been lucky (avoided major floods in the last 21 years), or rather has flood risk in these states been overestimated or successfully managed or reduced, such that these states subsidize the larger insurance pool?

Several mechanisms could explain why some US states may have better managed flood risk. These mechanisms are the subject of on-going research. If verified, these states may look to remedies that credit their investments, attention, enforcement and/or more diligent stewardship of their floodplains and coastlines. However, the penalty for getting the question above wrongly may be severe.

Preliminary analyses suggest that California consistently pays more into NFIP than is justified by historical damage claims.

Since 1994, NFIP damage payouts in California total just 14% of premiums collected. The three most damaging flood years in NFIP history have all occurred since 1994, and yet only the worst year of California flooding (1995) has cumulative NFIP payouts exceeding premiums collected statewide, and then only slightly ($1.35 in claims per $1.00 of premiums). Furthermore, a community-scale analysis of payout/premium patterns shows that only 18 of California’s 538 jurisdictions had cumulative NFIP payouts that exceeded premiums collected in that area. 119 jurisdictions, or 22% of California’s total, paid NFIP premiums over the full duration of study, but had zero payouts. One California region – the Central Valley — has been particularly outspoken about perceived unfairness in costs and restrictions imposed by NFIP (e.g., Government Accountability Office, 2014). Although we do not accept all claims of “floodplain exceptionalism” suggested by some Central Valley residents and growers, initial analyses suggest high NFIP premiums relative to historic claims – payouts are just 9% of cumulative Central Valley premiums. More detailed analyses of agricultural structures and flood losses are needed.

Policy Recommendation: California should explore a state flood insurance program, with savings invested in long-term risk reduction.

Current federal law requires that home and business owners with federally-backed mortgages must carry flood insurance. However, this mandatory insurance need not be through NFIP. In the past 2-3 years, more private insurers have selectively offered flood coverage. There is broad interest in privatization of flood insurance, including pending federal legislation (HR 2901 and S 1679), but concern exists from floodplain and flood-risk experts that privatization will reduce FEMA funding for floodplain mapping and mitigation activities. Perhaps more concerning is that private insurers will “cherry pick” flood policies now overpriced by NFIP and leave the NFIP as the insurer-of-last-resort, holding only grandfathered, repetitive-loss, and other “actuarial dogs” imposed by legislative mandate. This outcome would overwhelm NFIP with unsustainable debt.

Rather than relying on privatization to solve its flood-insurance inequities, California should move quickly to stake its place in this arena. This recommendation was earlier made by California’s Department of Water Resources in 2005: “Examine existing flood insurance requirements and consider the creation of a ‘California Flood Insurance Fund,’ … to compensate property owners for flood damage” (DWR, 2005). California should consider acting before private interests make state action untenable. Interesting public-private solutions are possible, such as partnering with private reinsurers to hedge the risk from low-probability, high-magnitude catastrophic floods. Many services funded by NFIP, such as flood-hazard modeling and mapping, are being done across California using tools half-a-century ahead of FEMA-funded contractors. California also leads the country in implementing flood mitigation measures, like bypass channels and levee setbacks, that simultaneously reduce flood risk for surrounding areas, enhance riparian and wetland habitats, promote agriculture, provide recreation, and support groundwater recharge. In implementing its own flood insurance program, California would be in a position to address many of the shortcomings of NFIP, remedying important issues like repetitive-loss properties, residual risk behind levees, and sovereign liability for flood damages.

California is in a position to do what it does best – not follow the nation, but lead. The state has the expertise, and the need, to set new precedents in sustainable flood-risk management.

Nicholas Pinter is the Roy Shlemon Professor of Applied Geosciences in the Department of Earth and Planetary Sciences and an affiliate of the UC Davis Center for Watershed Sciences. Rui Hui is a postdoctoral researcher with the Center for Watershed Sciences. Kathleen Shaefer is a prospective graduate student at UC Davis, and previously worked as a Regional Engineer for flood projects with FEMA Region IX.

Further Reading

Cutter, S.L., C.T. Emrich, D.P. Morath, and C.M. Dunning, 2013. Integrating social vulnerability into federal flood risk management planning. Journal of Flood Risk Management, 6: 32–344.

California Department of Water Resources (DWR), 2013. California’s Flood Future: Recommendations for Managing the State’s Flood Risk.

Governmental Accountability Office (GAO), 2014. National Flood Insurance Program: Additional Guidance on Building Requirements to Mitigate Agricultural Structures’ Damage in High-Risk Areas Is Needed, GAO-14-583.

Hayat, B. and R. Moore, 2015. Addressing affordability and long-term resiliency through the National Flood Insurance Program. Environmental Law Reporter, 4-2015.

National Wildlife Federation, 1998. Higher Ground: A Report on Voluntary Property Buyouts in the Nation’s Floodplains.

Rand Corporation, 2006. The National Flood Insurance Program’s Market Penetration Rate: Estimates and Policy Implications.

[divider] [/divider]