By David Crane, Lecturer and Research Scholar at Stanford University and President of Govern for California.

San Francisco’s pension costs are expected to rise three times faster than revenues over the next five years (see “Even San Francisco, Flush With Tech Wealth, Has Pension Problems,” Bloomberg) but another disclosure in the city’s latest Five-Year Financial Plan is equally troublesome:

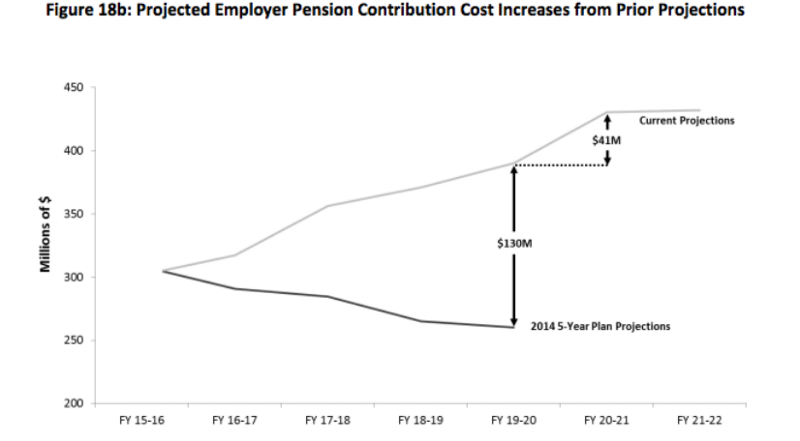

- Pension costs, which had already increased 5x in the ten years to FY2015, were projected by the last Five-Year Financial Plan to peak in FY2015;

- But the new Plan says those projections were wrong:

- So now the new projection is that pension costs are likely to decline “over a longer horizon.”

- However, that projection is “highly sensitive to a number of actuarial assumptions, most notably investment returns.” [emphasis added]

Want to guess the investment return assumption? It’s the same one used in the last projection. It’s 20 percent higher than 20th century returns for similar portfolios. It’s 15 percent higher than Warren Buffett assumes for his pension fund portfolio. It’s a rate not met during one of the longest bull markets in history. It falls into what Buffett characterizes as Alice-in-Wonderland territory.

Want to guess the investment return assumption? It’s the same one used in the last projection. It’s 20 percent higher than 20th century returns for similar portfolios. It’s 15 percent higher than Warren Buffett assumes for his pension fund portfolio. It’s a rate not met during one of the longest bull markets in history. It falls into what Buffett characterizes as Alice-in-Wonderland territory.

San Francisco officials don’t need Donald Trump’s help in crushing the city’s budget. They’re doing that on their own.

When public pension fund investment return assumptions aren’t met, citizens suffer cuts in services, higher taxes and fees, or both. With compound interest, every dollar by which the pension fund falls short of its assumption translates into three dollars of additional cost for citizens. For an understanding of why San Francisco’s officials persist in employing an unreasonable investment return assumption, see here.

San Francisco is facing more than $2.5 billion of shortfalls over the next five years. According to the Plan, rising pension costs are the biggest factor. In the absence of reform citizens have worse to fear.

*Thanks to Jefferson Airplane. Who would’ve thought the lyrics to “White Rabbit” would one day apply to investment return assumptions?

[divider] [/divider]