By Edward Ring.

With the 2018 general election a few weeks away, it’s time to review just how many tax increases are on state and local ballots in California. And while media attention focuses on the statewide tax measures, even bigger money is represented by the sum of hundreds of proposed local tax increases.

Every election cycle, the California Taxpayers Association (CalTax) produces a list of local tax and bond proposals. After every election, they provide information as to how many were approved by voters and how many failed. Using CalTax data, it can be seen that in November 2016, California’s local voters approved 181 bonds, mostly for school construction, totalling an incredible $32.3 billion. Annual payments on these bonds will cost California’s taxpayers an estimated $2.1 billion per year. At the same time, local voters approved 159 new tax measures, mostly increases to local sales taxes and parcel taxes, adding another $2.9 billion in annual payments.

If you add up all the voter approved new taxes in November 2016, state and local, you have to include not only $5.0 billion in new local taxes and payments on local bonds per year, you also have to add the voter approved statewide measures. That would include Prop. 51, adding yet another $9.0 billion in school bonds (estimated payments $585 million per year), and Prop 55, the extension of the “temporary” increase to state income taxes on personal incomes over $250,000 per year (estimated collections, between $4.0 billion and $9.0 per year), and Prop. 56, the $2.00 tax increase per pack of cigarettes (estimated collections just over $1.0 billion per year).

Before turning to 2018, it’s important to also note that in 2016 the Democrats recovered their two-thirds majority in the state legislature, meaning they could pass new taxes without voter approval. And in 2017, that’s exactly what they did, adding twelve cents per gallon to the already high state taxes on gasoline and increasing vehicle registration fees. Voila, another $5.4 billion per year in taxes on Californians.

When considering how California’s proposed new taxes will fare with voters in November, history is a good indicator. In November 2016, ninety-four percent of local bond measures were passed by voters, and seventy-one percent of new local taxes were approved. Similarly, this past spring, in the primary elections of 2018, California’s voters approved eighty-three percent of local bond measures ($200 million per year in annual payments), and sixty-five percent of new local taxes ($228 million in new taxes per year). Statewide, Californians approved a $4.0 billion “water” bond (Prop. 68), which equates to another $260 million per year in annual payments.

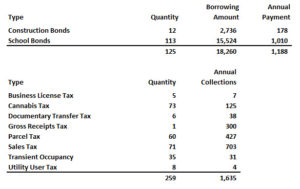

Which brings us to November 2018. The table below shows 125 new local bonds are proposed. If they are all approved by voters, that will add another $1.2 billion in annual payments. In addition, 259 new local taxes are proposed, which if approved will total another $1.6 billion in annual payments. This time, along with the perennial hikes to sales taxes and parcel taxes, the other popular new mode of taxation is marijuana, with 73 of California’s cities and counties proposing to cash in on sales of recreational cannabis.

California’s Local Tax and Bond Proposals – November 2018

If historical trends apply this time, California’s voters will likely approve four-fifths (or more) of the local bond measures, and two-thirds (or more) of the local tax increases. This will equate to roughly $2.0 billion in new taxes and payments on bonds per year. And then there are the statewide initiatives.

On California’s November ballot there are four bond proposals, totaling $16.4 billion in additional borrowing. Prop. 1 issues $4.0 billion in bonds for housing programs and veterans’ home loans. Prop. 2 sells future revenue from the millionaire’s tax for $2 to guarantee $2.0 billion in bonds for homelessness prevention housing – that’s tax revenue that has to be made up somewhere else, so yes, it counts. Prop. 3 issues a whopping $8.9 billion in bonds for water-related infrastructure and environmental projects. And Prop. 4 issues $1.5 billion in bonds for children’s hospitals. Total payments on these bonds? Another $1.1 billion per year.

To summarize, in 2016, voters approved new taxes and payments on bonds (not including the $4.0 to $9.0 billion per year in “millionaire” taxes that were not new, but were continued by the passage of Prop. 56) totaling $6.5 billion per year. In the 2018 June primary, California’s voters approved another nearly $700 billion in new taxes and payments on bonds. And this November, voters have the opportunity to approve (or reject), $3.6 billion per year in new taxes and bond payments.

For the children. For education. For safety. For safe drinking water. The list goes on, and the stories are compelling. But here’s the problem: Even if all of the 2018 tax and bond payments are approved, and those payments are added to the payments on new taxes and bonds already approved in Nov. 2016 and June 2018, the total is “only” $10.0 billion. Why “only”? Because the estimated payments on public employee pensions in California are estimated to increase from $31 billion in 2018 to $59 billion in 2024, and that is the “normal” scenario, not one reflecting the impact of a major correction in the value of stocks, bonds, and real estate.

Money is fungible. When more tax revenues go to pension funds, vital publicly funded programs are either defunded or new taxes are imposed to keep them alive. Similarly, when more tax revenues go to pension funds, maintenance projects that might have been funded using operating budgets, suddenly become capital projects requiring debt financing.

Californians may expect a deluge of new tax and bond proposals for many years to come.

[divider] [/divider]