By Ken Nordhoff, HdL Principal

Intro

The just-concluded 2020 year was certainly full of challenges across California. Social unrest, the COVID-19 pandemic crisis, plus unprecedented wildfires across the Golden State posed significant strains in addressing community needs. Last January was generally trending in a positive direction, however, beginning in March, many city, county and special district budgets began to experience rapid declines in key general fund tax resources.

Local governments once again are facing financial distress. Acknowledging different agencies have unique primary funding sources, it is common for many communities to rely on sales taxes as a major resource necessary for delivery of public services. Given what has transpired, I thought it would be helpful to examine sales taxes; see if any unique patterns emerge; understand short and/or long-term implications.

For context purposes, readers know the California basic sales tax rate of 7.25% includes a 1% local Bradley Burns component along with designated county portions directed to transportation, Prop 172 public safety and realignment programs. Specifically, I want to draw attention to the 1% Bradley Burns sales tax nuances over the last twelve months while offering insights as to what may lie ahead in 2021.

Behavioral Shifts

The coronavirus calamity necessitated lifestyle adaptation; previously normalized shopping behaviors changed overnight. Fewer people in stores, reduced trip destinations and heightened internet buying modified spending patterns. When analyzing taxes remitted last year, the following trends emerged:

- Non-essential retailer restrictions, both access and operational, reduced customer spending at local businesses; general consumer goods, restaurants and hotels suffered significant declines in tax filings. Plummeting fuel prices coupled with a lack of demand lessened fuel seller’s receipts.

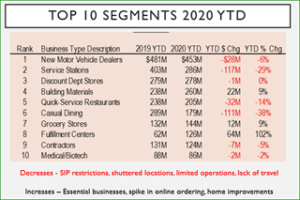

- Conversely, revenues grew from in-state fulfillment centers; essential businesses gains (e.g., building materials, grocers) captured housebound spending due to remote working and home improvement projects. The table below captures the top ten segments’ performance over the first nine months of 2020.

- Ecommerce sales escalated big time. Consumers dramatically increased online ordering through the holiday season, yielding significant growth in sales tax distributed through the county pools. For those who may not know, a long-standing ‘county pool’ system was devised years ago by CDTFA (formerly the SBOE) to allocate each city or county’s local share of use taxes. Contributors to the 58 county pools are primarily online purchases from out-of-state companies, remote sellers who ship merchandise to California destinations and private party vehicles sales.

- HdL’s statewide data is organized into eight industry groups and several regions for analysis and forecasting purposes. Of note:

- For January to September, county pool allocations rose higher by 33% over the comparable 2019 time and offset half of the 13% decline from brick-and-mortar locations.

- Regions with a greater focus on tourism, hospitality, airports, (LA and Orange Counties, Bay Area) suffered much greater pandemic quarterly tax losses and weaker recovery when compared to inland or rural parts of the State.

- Countywide pools, which were the fourth-highest tax producing category in FY 2018-19; catapulted to the top spot in FY 2019-20.

Irony Intersection

California’s AB147 appeared after the 2018 U.S. Supreme Court ruled in favor of the State of South Dakota, thus, previously held physical nexus arguments were replaced with a ‘virtual’ presence standard. Full enactment of AB147, including the Marketplace Facilitators Act, occurred as of September 30, 2020.

For California, over $1.9 billion in new statewide sales and use taxes (excluding add-on district levies) were remitted by marketplace facilitators during this implementation year; Bradley Burns captured $260 million that was allocated to local jurisdictions. For those who desire to learn more facts and figures about AB147, click HERE our recent HdL Issue Update.

Ironically, while AB147 was adding new revenues in California, along comes the COVID-19 pandemic. State and local leaders mandated shelter in place for households which are ongoing as of this writing.

Closures of restaurants/hotels/entertainment venues, dramatic reductions in air travel/tourism and numerous employees working remotely propelled sales taxes downward overnight. Uniquely, a random convergence occurred. The flow of new revenues prior to the onset of the pandemic induced economic freeze lessened what would have been even greater sales tax losses at all levels of government.

What May Come – 2021 and beyond

All are ready for this new year to be better, in so many ways. Questions come to mind as cities, counties and districts consider unique fiscal plights while implementing strategies to resolve budgetary concerns.

- The State LAO’s fiscal outlook* for FY 2021-22 stated a $26 billion windfall is entirely one time in nature; operating deficits are forecast the subsequent three years. Voters rejected Proposition 15 in the last election which would have raised $8 to $12 billion per annum in commercial property taxes for schools, community colleges and local governments. Given this measure’s failure and the looming State fiscal problems, is it likely the Sacramento tries to solve part of their monetary woes by raising revenues? When? How?

- The sales and use tax landscape evolved over the past decade, especially the expansive use of the internet. Unsuccessful attempts at reform/restructuring, such as SCA 20 and ACA 13, would have changed sales tax allocation formulas from a point of sale to a destination-based methodology, thereby redistributing the Bradley Burns 1% rate to local governments. Might similar types of legislation be introduced in this upcoming session and if so, how would it impact local governments?

- Taking matters into their own hands, many cities and counties have approved local district taxes. The November election saw 65 local add-on tax measures approved by voters; some imposed first time levies, others increased existing rates, extended, or eliminated sunset terms. Are you considering a local measure? General or special sales tax? Do you know the available transaction’s tax cap space that could limit your options?

The 2020 sales tax outcomes tied to COVID-19 forces are going to carry into 2021 and beyond. Broader deployment of curbside pickup, at-home delivery is here to stay. The mega-boost in online purchasing created a new baseline for countywide pool revenues; absent legislative changes or CDTFA rulings, this sector will remain a top tax-generating category for most jurisdictions. Communities with high concentrations of hospitality, leisure venues and travel-reliant businesses are going to recover slowly.

Round two of stimulus checks are likely directed toward household basics – rent, utilities, food; probably will not move the needle in terms of taxable purchases. The shift to spending on ‘goods’ this past summer will likely return back into services and non-taxable areas once the economy reopens in a meaningful way. Most important – the timing and pace of economic rebound is influenced by several factors, notably each agency’s local tax base composition and the successful deployment of Coronavirus vaccines.

Our experts at HdL do not expect the new year to be a return of “normalization”; sales tax spending, like human behaviors, evolves over time. However, we do believe future sales taxes should ‘normalize’ into new patterns that must be taken into consideration as agencies make critical decisions to address budgetary needs and long-term financial obligations.

* – State of California Legislative Analyst’s Office Fiscal Outlook, 2021-22 Budget published November 18, 2020

About HdL Companies

As the state leader in sales taxes, HdL’s knowledge and experience provides meaningful analysis, support and insights on local government revenues including sales, transactions and use taxes. Would you like to optimize revenue capture, explore new resource alternatives (such as cannabis or economic development) or reduce operating costs? We’re here to help. Contact us at solutions@hdlcompanies.com or 714.879.5000.