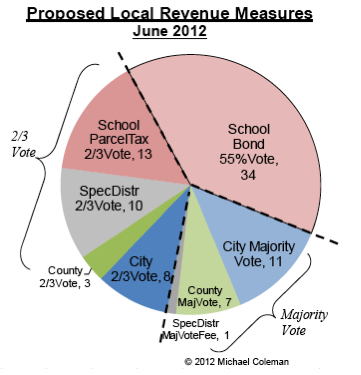

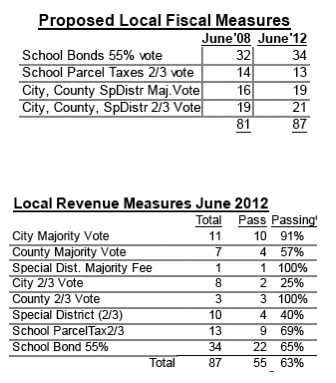

The June 5, 2012 California presidential primary election featured over 140 local measures on questions including land use development, government organization, bond authorizations and tax increases. Among these were 87 measures seeking approval for taxes, bonds or fees.

The June 5, 2012 California presidential primary election featured over 140 local measures on questions including land use development, government organization, bond authorizations and tax increases. Among these were 87 measures seeking approval for taxes, bonds or fees.

There were 34 separate K-12 schools district and community college bond measures, requesting a total of $2.32 billion to construct facilities, acquire equipment and make repairs and upgrades. There are 13 measures to increase school parcel taxes.

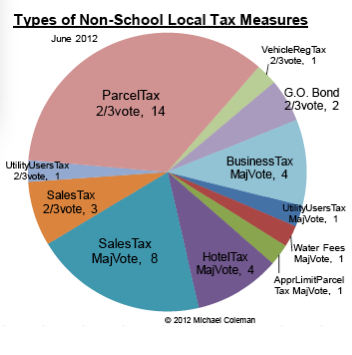

Among the 40 non-school local revenue measures are two city general obligation bond measures and 19 special taxes and parcel taxes requiring two-thirds voter approval. These include two county library sales tax extensions and a sales tax earmarked for fire and police in Parlier. The 19 majority vote measures include increases and eight add-on sales taxes, four hotel tax increases or expansions (all in counties), four business tax increases or extensions and one utility user tax increase.

|

|

Overall Passage Rates

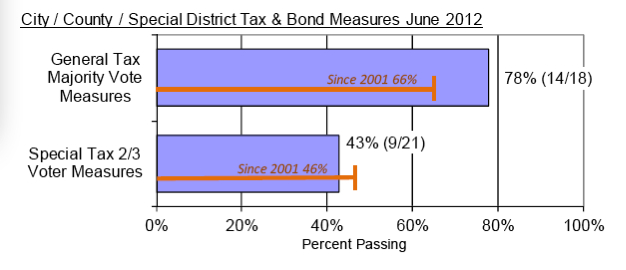

Preliminary election night tallies with all precincts reporting, indicate that 55 of the 87 local revenue measures passed. As in past elections, majority vote measures fared better than supermajority vote special taxes and bonds. Fifteen of the 19 majority vote measures passed, including all but one of the city measures. But 18 of the 34 two-thirds supermajority vote special taxes passed. School parcel taxes fared better, with nine of 13 passing versus just nine of 21 non-school special tax measures passing.

The overall passage rate of non-school local tax measures in June 2012 was similar to prior elections over the last decade. Over that time, voters have approved 66% of majority vote measures but only 45% of two-thirds vote special tax measures.

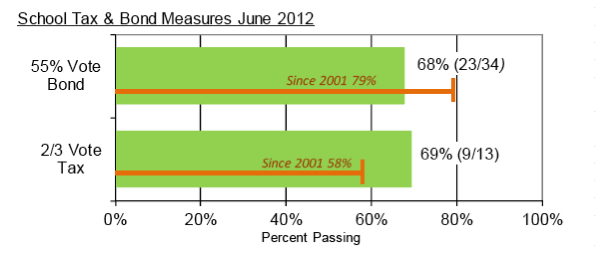

The proportion of passing school bond measures was somewhat lower than in prior years, but the proportion of passing school parcel taxes was slightly higher. Overall, passage rates for school measures were similar to prior years.

The proportion of passing school bond measures was somewhat lower than in prior years, but the proportion of passing school parcel taxes was slightly higher. Overall, passage rates for school measures were similar to prior years.

Local Add-On Sales Taxes (Transaction and Use Taxes)

Local Add-On Sales Taxes (Transaction and Use Taxes)

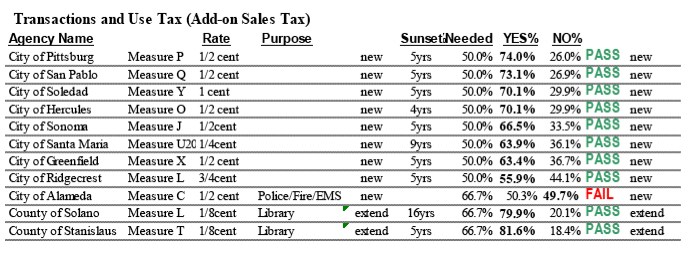

Nine cities asked their voters to consider sales tax add-ons (transactions and use taxes). Among these, only the City of Alameda chose to earmark the tax, making the measure a two-thirds vote special tax. Alameda’s tax was the only tax that failed, barely even garnering a majority approval.

Existing county library sales tax rates were renewed and extended in Solano County and Stanislaus County. The high passage rate for sales tax measures in this election exceeds that of previous elections. Since 2001, about 60% of measures to increase general purpose (majority vote) local sales taxes passed. Just 36% of two-thirds vote special sales tax increases passed during that time.

Transient Occupancy (Hotel) Taxes

Transient Occupancy (Hotel) Taxes

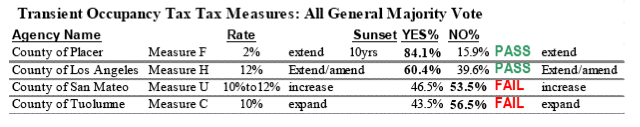

There were four measures to increase or expand Transient Occupancy (Hotel) Taxes. Measure F to extend the current hotel tax in the North Lake Tahoe area of Placer County passed as did the Los Angeles county to modernize and extend the existing 12% rate there. But a measure to increase the rate in unincorporated San Mateo County failed. Voters in Tuolumne County turned down a measure to expand the existing hotel tax rate in unincorporated areas to private campgrounds, recreational vehicle and boat stays.

Utility User Taxes

Utility User Taxes

There were just two utility user tax (UUT) measures on the ballot. The City of Parlier took the challenging approach of earmarking their proposed 5% rate for public safety services (police, fire and emergency services), thus triggering the requirement for two-thirds voter approval. The measure failed to even garner majority approval.

The general purpose measure in Stanton proposed to increase the existing 5% tax to 7.5% and to modernize and expand the tax to cover modern telecommunications technologies and billing methods. The measure was accompanied by a companion advisory measure advising that the proceeds from the increase for various priorities including maintaining public safety funding (police, fire and paramedic services), maintaining support for school programs (notably not a city function) and services to children, continuing other vital city services, restoring adequate reserves for fiscal stability, and providing for economic growth. The Stanton measure also included a provision allowing the rate to be adjusted “based upon CPI changes,” an unusual provision for a percent rate tax that inherently changes with growth in utility charges over time. The measure failed.

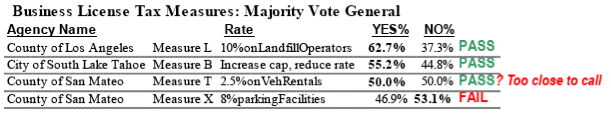

Business License Taxes

Business License Taxes

There were four business license tax measures. The County of Los Angeles sought voter approval to continue a 10% tax on the gross receipts received by operators of landfills in the unincorporated areas of the county for the disposal of waste in landfill facilities. The tax was originally adopted in 1991. The measure passed easily.

Measure B in the City of South Lake Tahoe reduced the gross receipts business tax rate across all categories, but increasing the maximum tax from $3,448 to $20,000 per calendar year and eliminating the cost of living increase. Voters approved the proposal.

The County of San Mateo placed two business tax measures on the ballot along with a transient occupancy (hotel) tax measure (see “transient occupancy taxes” above). Measure T imposes a 2.5% tax on the gross receipts of car rental companies in the unincorporated areas of the county. San Mateo County Measure X would have imposed a tax of 8% on the gross receipts of companies that operate commercial parking lots in unincorporated areas of the county, including valet parking at restaurants and hotels. The taxes largely effect businesses related to San Francisco International Airport.

Measure T was narrowly ahead pending final counts but Measure X failed. Identical measures in November 2008 fell short of the majority approval with 47% each.

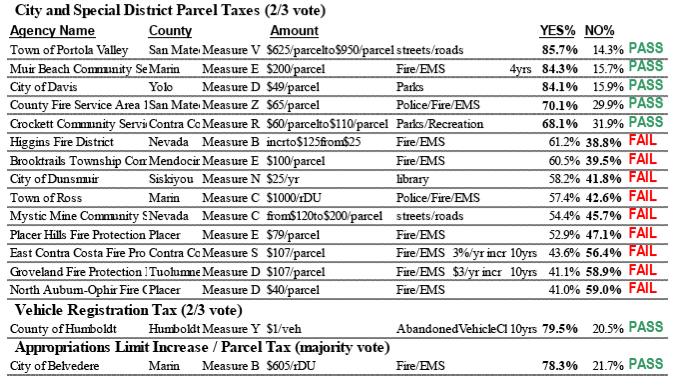

Parcel Taxes and Special Taxes (non-school)

Parcel Taxes and Special Taxes (non-school)

There were four city parcel taxes and ten special district parcel taxes. Under a state constitutional provision included in Proposition 13 (1978), parcel taxes require two-thirds supermajority approval. Just four of the 14 measures passed.

Among the nine taxes earmarked for police or fire and emergency medical transport (EMS) services, just two passed. The measures in the Hallmark area of San Mateo County and the Muir Beach Community in Marin County extended existing taxes. Voters in Davis extended their existing special tax for parks. The only non-school two-thirds vote parcel tax increase to pass was in the wealthy bay area Town of Portola Valley where road conditions were at issue. Voters in the upscale City of Belvedere approved an increase in the city’s appropriations limit (Cal Const Art XIIIB), thus allowing the city to increase a previously approved parcel tax.

Voters in Humboldt County approved an extension of the existing $1 per car registration special tax used for abandoned vehicle abatement.

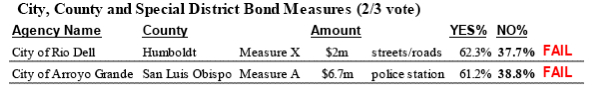

General Obligation Bonds

General Obligation Bonds

Two cities sought the two-thirds voter approval needed to issue general obligation bonds and the accompanying ad valorem property tax rate increase to pay the bond debt service. Both failed.

Voters in Arroyo Grande turned down Measure A authorizing the issuance and sale of $6.7 million to construct a new police station and retire bonds issued in 2003 for the construction of a fire station. The measure specified that the ad valorem tax rate to pay the 30 year bonds shall not exceed the existing rate approved in 2003 to pay for the fire station bonds, estimated at no more than $8.17 per $100,000 of assessed value.

Voters in the City of Rio Dell failed to approve the issuance and sale of $2 million in general obligation bonds to fund street improvements. The 15 year bonds would have been be repaid from an ad valorem property tax estimated at $119.62 per $100,000 of assessed value.

About half of the general obligation bond measures proposed since 2001 received the two-thirds voter approval needed.

School Parcel Taxes

School Parcel Taxes

School parcel taxes fared better than non-school parcel taxes. The ballot included 13 local school parcel taxes. All received well over 60% yes votes and nine passed.

School Bonds (55% approval)

School Bonds (55% approval)

There were 34 school bond measures on the ballot for a total of over $2.32 billion in bonds. Preliminary counts show 23 of the measures attained the 55% approval needed for a total of $1.856 million in new approved school bonds.

Employee Benefit Changes

Employee Benefit Changes

The closely watched public employee pension reform proposals in San Diego and San Jose both passed.

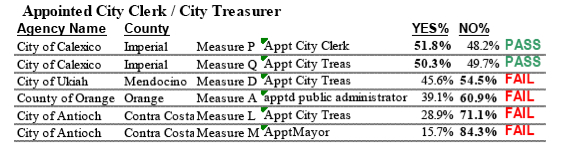

Appointed City Clerk, Treasurer, Administrator

Appointed City Clerk, Treasurer, Administrator

Voters in Calexico approved measures to allow their city council to appoint their city clerk and city treasurer rather than elect them. But similar measures failed in Ukiah and Antioch. Orange County’s proposal to have the Board of Supervisors appoint the county public administrator also failed. The Public Administrator position in Orange County protects the assets and manages the affairs of residents of the county who die with no known heirs, no will or qualified executor, and no qualified administrator of the estate. The office is presently an elected office.

Charter Cities

Charter Cities

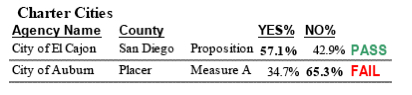

Voters in El Cajon approved a measure to establish a city charter, providing the city with certain additional authority not afforded to general law cities. Voters in Auburn turned down charter city status.

For more information: Michael Coleman 530-758-3952. coleman@muni1.com

Californiacityfinance.com

© 2012 Michael Coleman. Reprinted on PublicCEO.com with permission.