Stanford Study Shows Pension Spending Grew 11.4 Percent Per Year Since 1999, More Than Any Other Municipal Expenditure Category

The Stanford Institute for Economic Policy Research (SIEPR) and California Common Sense (CACS) published a report documenting public pension problems among California’s independent, or non-CalPERS pension systems. The report is authored by California Common Sense (www.cacs.org) researcher and Stanford junior Evan Storms and Stanford Professor Joe Nation.

The study covers the top 24 independent systems across California, including those in the counties of Alameda, Contra Costa, Fresno, Kern, Los Angeles, Orange, Sacramento, San Diego, San Francisco, San Joaquin, San Mateo, Santa Barbara, Sonoma, Stanislaus and Ventura and in the cities of Fresno, Los Angeles, San Jose, and San Diego. The 24 systems account for more than 99 percent of independent system assets.

Among the findings from the report:

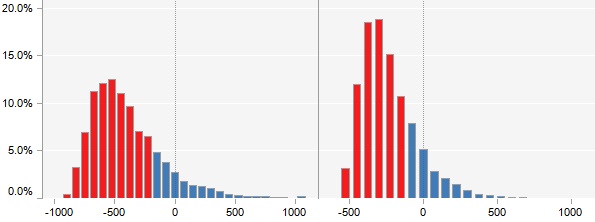

- The June 2011 funded ratio for the aggregated 24 systems is 53.6 percent, based on an assumed rate of return, or discount rate, of 5 percent.

- The City of Fresno’s two systems have an aggregate funded ratio of 78.5 percent, while the Kern County system is only 41.5 percent funded. None of the systems is at or above 80 percent funded, which is the conventional benchmark for the minimum funded ratio.

- The unfunded liability for the aggregated 24 systems is $135.7 billion.

- Benefit levels vary significantly. The average annual pension benefit in 2009-2010 for miscellaneous members was $34,461; for safety members, it was $67,718. This includes all beneficiaries, regardless of the number of years of service (career retiree data was unavailable).

- For miscellaneous employees (regardless of years of service), the highest annual benefit in 2009-2010 was $46,211 in Los Angeles City, and the lowest was $24,179 in Stanislaus County.

- A majority of independent systems base final average salary on the last one year of work, while a minority based this on three years. All systems contain some form of cost of living adjustment.

- Average benefits for retired safety employees range from a low of $48,732 in Fresno County to $90,612 in the City of San Jose (regardless of number of years of service).

- The aggregate reported 2011-2012 employer contribution rate is 23.8 percent. About one-half of this rate is due to contributions for unfunded liabilities.

- Aggregate pension costs were 4.1 percent of aggregate municipal spending in 1999; by 2011, that figure had more than doubled. The highest share is 17.7 percent in San Mateo County and the lowest is 6.0 percent in Los Angeles County. Between 1999 and 2010, pension spending grew at 11.4 percent per year, more than the rate of growth for any other expenditure category.

- If pension systems assumed a 6.2 percent average annual rate of growth, which is a typical rate of return for private systems, pension costs would total 17.4 percent of all municipal expenditures.

- The 24 systems discount their liabilities at an expected rate of return, typically 7.75 percent. This practice is at odds with standard practice in economics, which holds that pension liabilities are full-recourse obligations that must be paid without regard to the performance of pension fund investments. Thus, each system substantially understates liabilities and overstates funded ratio.

This study is available on the SIEPR website at siepr.stanford.edu or at http://www.cacs.org.

Visit www.cacs.org/transparency_pensions.php to see a suite of interactive data visualizations created by California Common Sense that illustrate the findings of this report and in particular funding status of pension systems throughout California under a range of assumptions.

This project was supported in part through funding from The James Irvine Foundation and California Forward.

Information in this posting was taken from a CACS Press Release dated 2/21/12.