Originally posted at CalPensions.

By Ed Mendel.

The rapidly growing cost of state worker retiree health care, a more generous benefit than received by active state workers, soon could be taking a bigger bite out of the state general fund than pensions.

As if trading places, a new forecast expects the annual general fund payment for state worker retiree health care, now $500 million less than the payment for pensions, to be $500 million more than the pension payment in six years.

A forecast from the nonpartisan Legislative Analyst’s Office last month projects that a $2.3 billion general fund pension payment to CalPERS this fiscal year will grow to $2.8 billion in fiscal 2019-20.

State general fund spending on retiree health care for state workers, $1.8 billion this fiscal year, is projected to grow more than 10 percent a year during the same forecast period, nearly doubling to $3.3 billion.

“This growth is driven by two elements: (1) projected annual growth in state employee and retiree health plan premiums and (2) a rising population of state and CSU retirees,” said Legislative Analyst Mac Taylor’s “California Fiscal Outlook.”

Governor Brown’s 12-point pension reform plan in October 2011 mentioned “the anomaly of retirees paying less for health care premiums than current employees.” But pension reform legislation that took effect last Jan. 1 does not include retiree health care.

State worker retiree health care pays 100 percent of the premium of the retiree (the average cost of several of the largest health plans) and 90 percent of the premium for dependents.

For the health care of active workers, the state usually pays 80 or 85 percent of the premium for the worker, depending on labor contract bargaining, and 80 percent of the premium for dependents.

Active workers and retirees both had the “100/90” health benefit before a cost-cutting change made in 1991 under the administration of former Gov. Pete Wilson required active workers to begin paying some of the cost of their health care.

The Legislative Analyst’s projections of CalPERS costs makes several assumptions: investments will hit the 7.5 percent earnings target, no pay increases beyond current contracts and CSU will pay some increased pension costs.

State general fund spending, about $100 billion this fiscal year, pays for schools, health, welfare, higher education and other programs. Nearly all of the retiree health care payment comes from the general fund.

Spending from various special funds, about $42 billion, pushes the overall state payment to the California Public Employees Retirement System this fiscal year well beyond the $2.3 billion from the general fund to a total of $3.8 billion.

Often referred to under a bureaucratic label that cloaks its identity, “Other Post-Employment Benefits,” retiree health care moved into the spotlight last decade when new accounting standards directed governments to begin calculating and reporting the debt.

Now the estimated debt or “unfunded liability” for retiree health care promised current state workers over the next three decades is by one measure about 40 percent larger than the CalPERS unfunded liability for state worker pensions.

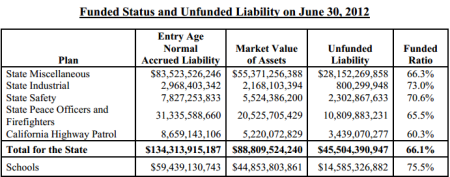

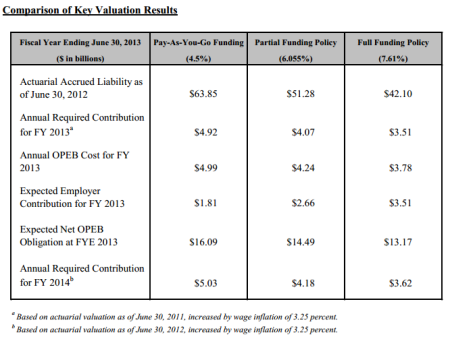

The retiree health care unfunded liability for state workers is $63.8 billion, state Controller John Chiang reported last February. The unfunded liability for state worker pensions is $45.5 billion, according to a CalPERS actuarial valuation as of June 30 last year.

State retiree health care is “pay as you go,” with little money set aside to invest and help pay or “pre-fund” future pensions. Pre-funding can lower long-term costs and avoid or reduce debt passed to future generations for services they did not receive.

“The current pay-as-we-go model of funding retiree health benefits is short-sighted and a recipe for undermining the fiscal health of future generations of Californians,” Chiang said in a news release last February.

“However, today’s challenge won’t necessarily become tomorrow’s crisis if policymakers can muster the fiscal discipline to invest now so that we can pay tens of billions of dollars less later.”

Because state retiree health care is “pay as you go,” the controller’s report uses a borrowing cost, 4.5 percent a year, to offset or discount future pension obligations, rather than the earnings-based CalPERS discount rate of 7.5 percent.

But even with a 7.61 percent earnings forecast, said the controller’s report, the retiree health care unfunded liability is $42.1 billion, nearly as much as the $45.5 billion pension debt.

Two decades ago, legislation by former Assemblyman Dave Elder, D-Long Beach, created a state worker retiree health care fund. But the Legislature chose not to put money in the fund.

The controller’s report estimates that the state would have to pay an additional $3 billion this fiscal year to begin fully funding the retiree health care promised current workers.

State workers contribute toward their pensions, 8 to 11 percent of pay, and employers contribute 21 to 35 percent of pay. Now several state worker unions are beginning to make contributions to their retiree health care.

The Highway Patrol redirected a 2 percent of pay retiree health care contribution to pensions in 2010 during the budget squeeze. Part of a Highway Patrol pay raise last July, 1.9 percent, was directed to retiree health care, triggering a state match in 2015.

Bargaining units representing operating engineers and physicians and dentists agreed to begin contributing 0.5 percent of pay to retiree health care last July. Three bargaining units have not yet agreed to new contracts.

Can retiree health care be cut or is it protected like pensions? A widely held view is that courts have ruled the pension promised at hire becomes a “vested right,“ protected by contract law, that can only be cut if offset by a new benefit of equal value.

A state Supreme Court ruling in an Orange County suit in 2011 said that governments can create an “implied contract” for retiree health care, even if not specifically stated by an ordinance or resolution.

Two rulings in September: A superior court judge overturned a freeze on retiree health care for Los Angeles city attorneys, finding an implied contract. A federal judge tossed a suit to overturn Sacramento County retiree health care cuts, finding no contract.

While projecting a future surplus in the state general fund, the Legislative Analyst’s report suggests using some of the money to reduce the unfunded liabilities of state worker retiree health care, UC pensions and the California State Teachers Retirement System.

An additional $500 million each year would provide $3 billion a year for these debts by fiscal 2019-20.

“Even if the state provides this added annual funding, additional payments from other units of government and public employees — or other policy changes — would be required to address these unfunded retirement obligations over the next three decades or so,” said the Legislative Analyst’s report.

Controller report’s chart shows pay-as-you-go funding and alernatives