When government workers are temporarily promoted shortly before retirement, do they get the same pension increase as a permanent worker in the job — or would that open the door for “spiking,” the intentional tweaking of final pay to boost pensions?

The issue split the CalPERS board this month in a 6-to-4 vote approving anti-spiking regulations for Gov. Brown’s pension reform legislation, which covers most state and local government workers hired since Jan. 1 last year.

While giving new hires lower pensions, the Public Employees Pension Reform Act also limits their ability to spike with a list of items that are not “pensionable compensation,” such as overtime, bonuses and pay for unused sick leave and vacation.

“Temporary upgrade pay” was not on the list. After talks with labor, employers and the Brown administration reached no consensus, the CalPERS staff, reversing its previous position, drafted regulations making temporary upgrade pay pensionable.

The split vote sent the regulations, approved as drafted, out for a 45-day public comment period. The new rules and the comments will come back to the board for final approval or changes triggering another comment period.

“If someone is put into a higher-paying position at the end of their career, not on merit, that seems to present the potential for pension spiking,” said board member Richard Gillihan, a Brown administration official who voted “no” on the new rules.

If employers left positions open for retiring employees, CalPERS could look at the problem case-by-case, replied Danny Brown, a staff member. He said temporary “out-of-class” work can be common, and staff felt extra duties deserve the usual extra benefits.

The reform limits spiking by using the highest three-year average of pay to calculate pensions for new hires, rather than the highest single-year pay used for previous hires not covered by the reform.

“If you were in a temporary upgrade long enough that it impacts your three-year final comp, it’s been more than an ad hoc promotion,” said board member J.J. Jelincic, referring to the reform disallowing “any one-time or ad hoc” pay.

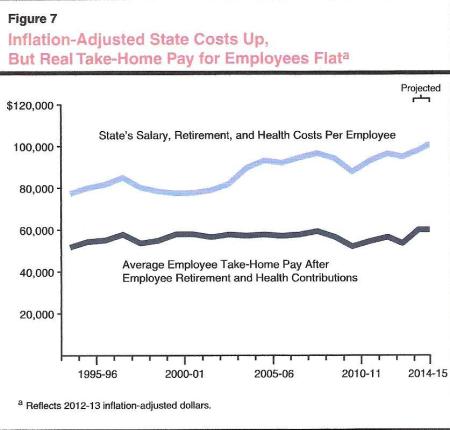

Board member George Diehr disagreed, citing a report issued last month by the nonpartisan Legislative Analyst’s Office, “State Worker Salary, Health Benefit, and Pension Costs,” specifically pages 11 and 12.

Diehr said the report shows that when adjusted for inflation the average state worker’s take-home pay (after pension, health, Social Security and Medicare payments) has been relatively flat over the last 20 years.

But the report said the inflation-adjusted state cost of providing salary and health and retirement benefits for the average employee during the last two decades increased from about $77,000 a year to more than $100,000.

“This is yet another item that would increase it,” Diehr said of making temporary upgrade pay pensionable. “So the notion that this would come at no cost is certainly not true.”

LAO chart shows flat take-home pay and rising state cost

After the pension reform bill, AB 340, was signed by Brown, CalPERS issued a circular letter in December 2012 on “pensionable compensation” for new hires covered by the reform.

Six types of pay that are pensionable for workers hired before the reform took effect Jan. 1, 2013, were excluded for workers hired after that date, including bonuses, employee pension contributions paid by employers and temporary upgrade pay.

Why did the CalPERS staff reverse its position and make temporary upgrade pay pensionable in the new regulations?

A reason given in a staff report to the board is based on one of the many provisions in a “cleanup” bill, SB 13, that made “technical changes” to clarify the legislative intent of the reform bill.

Unions might be expected to push for more pensionable pay items that boost pensions. But the cleanup bill provision allows state worker unions to exclude pay items from pensionable compensation through collective bargaining.

The staff report explains the value of the seemingly puzzling provision: “By passing legislation allowing the ability to exclude, it would seem to infer that items other than base pay are included.”

Some had argued that only base pay was pensionable under the reform bill. If items other than base pay can be excluded, staff reasoned, then there would seem to be items beyond base pay that are pensionable, like the “normal monthly rate of pay.”

So, after passage of the cleanup bill, CalPERS staff reversed its position on temporary upgrade pay, concluding that it’s pensionable. A temporary upgrade may not be base pay, but it does have a “normal monthly rate of pay for services rendered.”

The circular letter in 2012 excluded temporary upgrade pay because it was characterized as “ad hoc” due to typically “limited duration,” the staff report said, and the reform bill prohibits “ad hoc” pay items.

This month the CalPERS benefits committee removed temporary upgrade pay before sending the draft regulations to the full board, apparently intending to give the disputed issue more study.

At the full board, member Michael Bilbrey made a motion to restore the staff recommendation on temporary upgrade pay. Board president Rob Feckner said a senior legislative leader and a veteran legislative aide told him CalPERS staff “got it right.”

Voting for the complete draft regulations recommended by the staff were Bilbrey, Jelincic, Priya Mathur, Ron Lind, Steve Coony for state Treasurer Bill Lockyer and Terry McGuire for state Controller John Chiang.

Voting “no” were Gillihan, Diehr, Richard Costigan and Bill Slaton. Henry Jones was absent. Feckner customarily does not vote unless there is a tie. A seat designated for a governor appointee representing the insurance industry is vacant.

The ability to bargain to exclude items from pensionable compensation is not the only special treatment under pension reform given to state workers, but not to the other two CalPERS member groups: local government and non-teaching school employees.

The pension reform requires that most new hires pay at least 50 percent of their pension “normal cost,” the amount needed to cover future pension obligations earned during a year but not the debt or “unfunded liability” from previous years.

New state workers are excluded from the requirement to pay 50 percent of the normal cost, with the exception of employees of the Legislature, California State University and the courts.

This month the CalPERS board approved a rate increase for new hires in the Legislature and CSU peace officer and firefighter plans, up 0.5 percent of pay to a total of 11 percent of pay.

[divider] [/divider]

Originally posted at CalPensions.