A bill by state Sen. Steven Glazer, D-Orinda, giving new state workers the option new University of California workers received two years ago, a 401(k)-style plan rather than a pension, is opposed by unions and soon may be opposed by CalPERS.

More than a third of eligible new UC employees have chosen a 401(k)-style plan. Instead of a guaranteed lifetime monthly pension check, the 401(k) plan that replaced pensions in most of the private sector uses individual tax-deferred investments to build a retirement fund.

A 401(k) plan avoids pension debt, now a soaring cost for many governments. Employers only make a “defined contribution” to the retirement fund of an active employee. As critics point out, the risk of investment loss is shifted from the employer to the employee.

But as the UC example seems to show many employees, apparently not planning a full government career, prefer a portable investment plan they can control and take with them to a new job.

“This pension reform idea would be good for employees and provide a more stable fiscal foundation for the state,” Glazer said in a news release. “This new retirement plan would be especially attractive to millennials who do not intend to work for the state their entire lives.”

Orinda and two other cities in Glazer’s district, Lafayette and Danville, are among the few California cities that give employees 401(k)-style retirement plans, not pensions. The cities get police and fire services from the Contra Costa County Sheriff and fire districts.

“Most employees do not spend their entire career in state employment,” Glazer’s news release said. “Younger employees who work as long as 15 years for the state would likely be better off with their own retirement plan.”

Pension systems usually have a “break-even point,” the years of service needed before employee contributions begin to earn pension benefits that exceed the value of the same amount of money invested in an idealized 401(k) plan.

Two studies found different “break-even points” for CalSTRS, which has a back-loaded formula that increases pension amounts as teachers near retirement age. For teachers starting at age 25, an Urban Institute study said it was 24 years, a UC Berkeley study 20 years.

The first committee hearing on Glazer’s bill, SB 1149, originally scheduled for today, has been reset for April 23. More than a dozen unions have filed letters of opposition with the Senate Public Employment and Retirement Committee.

Many of the union opposition letters mention the shift of investment risk to employees, potential problems created by a five-year vesting period and a 401(k) employer contribution limited to the pension normal cost, and questions about investment fees and management.

One of the letters mentions a common worry among public pension supporters. Some reformers want to shift government employees to 401(k) plans, following the trend among private-sector businesses that eliminates pension debt.

A California Faculty Association letter said the bill “would promote 401(k)-style retirement plans over more state-run pension plans” and would set a “dangerous precedent” by allowing state employees to opt out of CalPERS.

“This legislation raises very strong concerns as it would weaken CalPERS by allowing individuals to opt-out and take state contributions out of the system,” said the faculty association letter.

When the CalPERS board was told last month that the staff was analyzing the Glazer bill, board member Theresa Taylor said: “It’s my understanding that as we pull employees out into another fund essentially what you are doing is weakening the pension fund.”

Taylor said she assumed that after the analysis CalPERS would be opposed to the Glazer bill. Mary Ann Ashley, CalPERS legislative affairs chief, briefly nodded her head in agreement.

“OK, that’s what I thought,” said Taylor.

Gov. Brown ran into a similar labor-CalPERS roadblock on a major cost-saver in his 12-point pension reform, a federal-style “hybrid” plan that combines a much smaller pension with a 401(k)-style plan.

“As a matter of fact when I read the PERS analysis they say if you close the system of defined benefit (pensions) and don’t let any more people in, then the system would become shaky,” Brown told a legislative hearing in 2011.

“Well, that tells you you’ve got a Ponzi scheme,” the governor said.

“Because if you have to keep bringing in new members then the current system itself is not in a sustainable position,” he said. “So I don’t accept that, and we don’t need to close it off, anyway. But we do have to make sure that this system is sustainable over the long term.”

In a Ponzi investment fraud, made famous by convicted Wall Street swindler Bernie Madoff, money used to pay investors returns on their accounts comes not from earnings but from new investors.

Passage of the rest of Brown’s pension reform led to the UC 401(k) option. The governor wanted a cap on UC pensions similar to the one his pension reform imposed on state and local government hired after Jan. 1, 2013, under his Public Employees Pension Reform Act.

UC officials said pensions aid in recruiting top talent, particularly when competing with private universities that offer higher salaries but a 401(k) plan. A UC task force proposed that a 401(k) plan supplement capped pensions and also be offered to new hires as a pension alternative.

Weakening the UC pension plan by diverting new members apparently was not an issue. A number of unions agreed to the 401(k) option, including 11,000 clerical workers represented by the Teamsters.

On leaving state government, employees can get a refund of their CalPERS contributions with interest or leave their money with CalPERS and collect a pension when they retire.

Glazer’s bill is more generous, giving a departing 401(k) member their contribution plus the matching employer contribution, with investment gains. The employee contribution is the same as the pension contribution for those under PEPRA.

The employer contribution is the same as would have been contributed for the pension “normal cost” if the employee did not have a 401(k). The “normal cost” presumably covers the cost of a pension earned during a year.

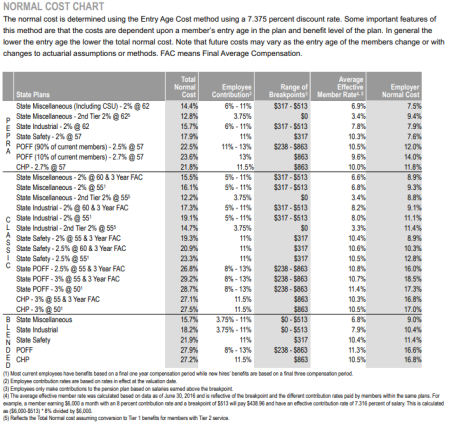

For “miscellaneous” state workers, the current average PEPRA employee rate is 6.9 percent of pay and the employer normal cost contribution is 7.5 percent (see CalPERS chart below). Private-sector employer 401(k) contributions have been averaging about 4.5 percent.

The “unfunded liability” payment, often higher than the normal cost, is only paid by the employer. It covers debt from previous years, mostly due to below-target investment earnings or a change in actuarial assumptions such as lowering the earnings forecast.

State workers have had retirement plan choices in the past. A cost-cutting measure in 2004 to help pay off a never-issued pension bond proposed by former Gov. Arnold Schwarzenegger put the first two years of employee contributions into a 401(k)-style plan.

When the Alternate Retirement Program ended last Oct. 31, only 915 of the 57,405 participants had chosen to put the contributions into a Savings Plus Program 401(k), a supplemental program for state workers, said Amy Morgan, a CalPERS spokeswoman.

Most employees chose to put their contributions into their CalPERS pensions. But 40 percent (22,934) made no choice and their contributions defaulted into a Savings Plus 401(k) or 401(a). They have the option of purchasing two years of service credit for their pensions.

In 1984 legislation by former Assemblyman Dave Elder, D-Long Beach, gave most state workers the option of switching to a lower-paying pension that did not require an employee contribution, then 5 percent of pay.

“CalPERS found that 47 percent of new workers from 1984 to 1988 chose the lower pension tier, which did not require any payroll deductions from employees,” a Little Hoover Commision report said in 2011.

The optional lower pension formula “1.25 at 65” (1.25 percent of final pay for each year served at age 65), down from the previous “2 at 60,” was given to all new hires during a state budget crunch in 1991.

A massive CalPERS-sponsored pension increase during a high-tech stock market boom, SB 400 in 1999, gave most state workers a “2 at 55” pension. Now the PEPRA pension for new non-safety state employees is “2 at 62.”

[divider] [/divider]

[divider] [/divider]