Originally posted at CalPensions.

By Ed Mendel.

A federal judge ruled San Bernardino eligible for bankruptcy last week, despite opposition from CalPERS, and then pressed the city to promptly deliver something the big pension fund wanted prior to the ruling: a plan to cut debt and exit bankruptcy.

A sketchy plan issued by San Bernardino last November called for a “fresh start” that would “reamortize CalPERS liability over 30 years,” perhaps in a way that would “realize value of $1.3 million per year starting fiscal year 2014.”

U.S. Bankruptcy Judge Meredith Jury said last week that San Bernardino should prepare an outline or “term sheet” of its bankruptcy exit strategy for mediation to be conducted soon by retired U.S. Bankruptcy Judge Gregg Zive of Reno.

After briefly conferring with city finance officials, an attorney for San Bernardino told the judge the city could have a term sheet ready by the end of the year or early January.

“You are making my (eligibility) ruling look bad,” Judge Jury told attorney Paul Glassman. “You are digging yourself in a hole, and you are going to get a reconsideration. Think some more.”

The judge was told that the city needs a CalPERS valuation due in mid-October, a fiscal 2011-12 city budget audit due in a month, a ruling on a union contract, and the outcome of a November election city council election that includes a recall.

(The seven-member city council could have five new members. Three members are up for re-election. Two members face a recall after a judge ruled last week that signature-gatherers followed proper procedure.

(Also facing a recall is the city attorney, James Penman, regarded by some as divisive and too close to the unions. He twice ran and lost against Mayor Patrick Morris, who is not seeking re-election.)

The judge said the city doesn’t need exact numbers to draft a concept, which is not a final “plan of adjustment” to cut debt. She urged the city not to get hung up on detail, noting for example that “ballpark” CalPERS figures should be available.

“It makes me question whether there ever was an end game,” the judge said.

A CalPERS attorney told the judge the city hired an actuary, Bartel and Associates, which met with CalPERS and should have enough information to make an estimate before the valuation is issued next month.

The city asked for a brief continuance on the term sheet issue. The judge set a phone conference for 11 a.m. tomorrow (Sept. 4).

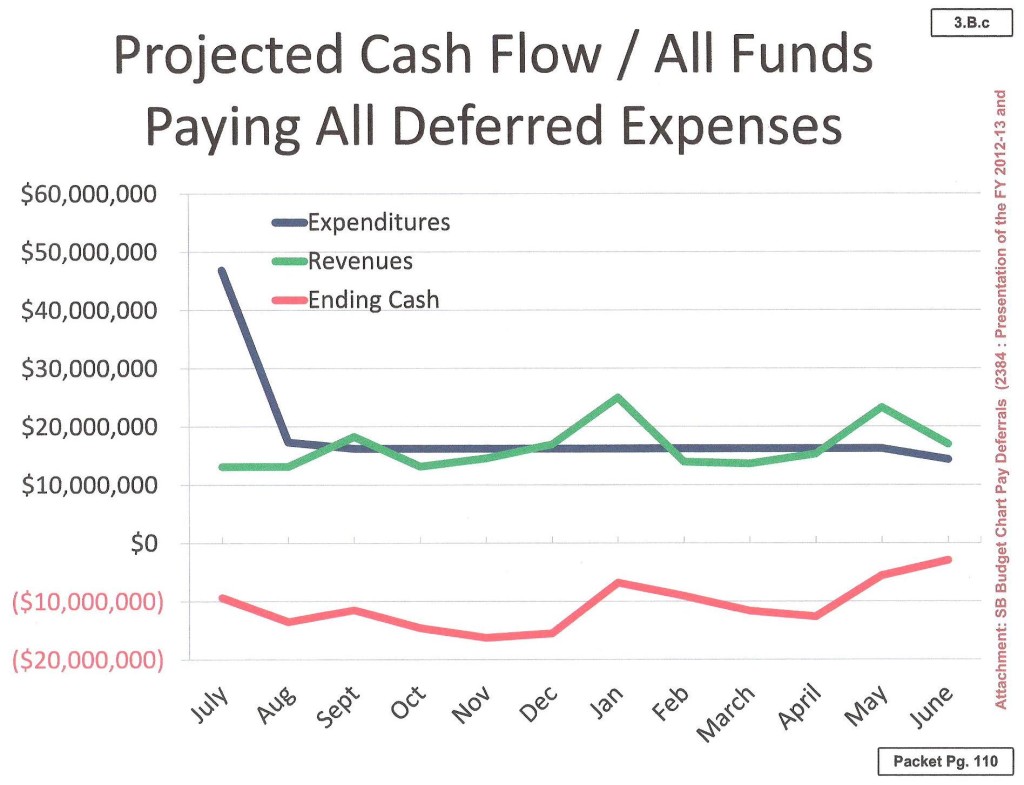

San Bernardino spending dropped after bankruptcy (April budget packet)

The California Public Employees Retirement System became the lone opponent to San Bernardino’s eligibility for bankruptcy when a middle-manager union agreed to a new contract early last month.

After an emergency filing for bankruptcy on Aug. 1 last year automatically stayed debt collection, San Bernardino took the unprecedented step of not paying CalPERS during the last fiscal year.

The city skipped more than $13 million in payments to CalPERS before resuming employer payments from the deficit-ridden general fund when the current fiscal year began in July.

Unlike Stockton and Vallejo, which paid CalPERS while in bankruptcy, San Bernardino proposed that its pension obligations, regarded by many as untouchable under a series of state court decisions, be restructured in federal bankruptcy court.

In a 1½-hour explanation of her ruling, Jury addressed the main CalPERS contentions that the city created a crisis, failed to negotiate with creditors, did not act in good faith, has no restructuring plan and deliberately withheld key financial information.

“I don’t believe anybody in this courtroom seriously thought the city was not insolvent,” said the judge.

San Bernardino officials, citing years of faulty management, said a new city manager and finance officer discovered a large deficit last year. The city said an emergency bankruptcy filing was needed to have enough cash to meet the August payroll.

Jury seemed puzzled about what CalPERS expected to gain by opposing San Bernardino’s eligibility for bankruptcy. She said the only apparent alternative is dissolving the city.

“How does that help CalPERS if the employees aren’t paid?” she said.

An attorney for CalPERS, Michael Gearin, said ruling San Bernardino eligible for bankruptcy is a “dangerous precedent” that might encourage other debtors to create a “self-inflicted crisis” and file for bankruptcy without pursuing alternatives.

“We don’t think that’s a proper precedent,” Gearin told the judge. “We think it’s bad policy, and that’s why CalPERS continues to object to eligibility.”

The San Bernardino city attorney facing recall, James Penman, said in a note read to the judge that city officials would not put themselves through the “daily recurring pain” and “public outcry” resulting from bankruptcy if it was not necessary.

“It is an emergency room, not a health spa,” said Penman’s note.

An attorney for bond insurer Ambac, David Dubrow, told the judge by phone his firm considered opposing eligibility but concluded that San Bernardino was an “outlier” that could pass the crucial insolvency test.

Since the judge posed the question, Dubrow said he would offer his theory about what CalPERS expected to gain if the judge dismissed the San Bernardino bankruptcy: “tremendous leverage.”

If San Bernardino was not in bankruptcy, Dubrow said, the city pension plan could be terminated, allowing CalPERS to place a lien on city assets. The judge blocked a CalPERS attempt to sue San Bernardino for payment in state court.

Last April the CalPERS board approved a proposal to sponsor legislation placing a “present lien” on local government assets without terminating pension plans. The bill is not expected to be introduced until next year.

Bond insurers and pension systems can be adversaries in the current wave of bankruptcies. In Vallejo, bond payments were cut. Council members said they decided not to try to cut pensions after CalPERS threatened an expensive legal battle.

Stockton wants to cut bond debt but not pensions, saying they are needed for a competitive workforce. Two bond insurers, Assured Guaranty and National Public Finance Guarantee, argue that the plan to cut bond debt but not pension debt is unfair.

Ambac agreed to cut Stockton debt payments for a housing project. If Assured and National do not reach a similar agreement, the judge has said he may rule on the pension-bond fairness issue after Stockton submits a “plan of adjustment” later this month.

After Judge Jury’s ruling on San Bernardino eligibility last week, CalPERS said it’s “considering its options for appeals” but will “continue to participate in the bankruptcy process in good faith.”