Written by: Tracy Vesely

Written by: Tracy Vesely

History

Proposition 172 is the byproduct of California budget deficits and the resulting Education Revenue Augmentation Fund (ERAF). Simply put, ERAF shifted property tax dollars away from local governments to shore up school funding. As a backfill measure, voters approved a half-cent sales tax in 1993 dedicated to local public safety – Proposition 172.

These funds are intended to maintain public safety services (police, fire, district attorneys, and corrections), not necessarily enhance them. The current law contains a “maintenance of effort” requirement to ensure these restricted resources are dedicated to public safety and not diverted for other uses.

Allocation

The California Department of Tax and Fee Administration (CDTFA) collects the Proposition 172 half-cent sales tax and apportions to each of the state’s 58 counties based on a county’s proportionate share of statewide taxable sales in the prior calendar year (see pro-rata factor explanation). This allocation method is similar to how cities and counties are apportioned revenues from their countywide use tax pools.

California Government code section 30051 et al outlines the Proposition 172 Public Safety Fund law, including allocation methodologies. Since FY 1996–97 and each year thereafter, the County Auditor is required to establish a Public Safety Augmentation Fund to receive Proposition 172 revenues. Amounts deposited in this fund shall be expended exclusively for public safety services and allocated among the county and eligible cities.

County Auditors distribute allocations to local agencies based on an agency’s proportionate share of net property tax loss due to ERAF. Cities that did not receive property tax or did not exist in 1980 are not affected by this phase of ERAF and are ineligible for these revenues. In addition, State law provides for nine counties with unique allocation formulas. In all cases, each of the 58 counties retain an excess of 90% of Proposition 172 revenues, while the remainder is shared with eligible municipalities.

Pro-rata Factor

Each county’s share of Proposition 172 revenues is set by a pro-rata factor that is determined by that county’s ratio of sales tax collections to the statewide total in CDTFA’s most recent annual taxable sales report. Each county’s pro-rata factor is adjusted annually based on the prior calendar year’s local Bradley-Burns 1% allocations. For example, allocations for FY 2021-22 are based on calendar year 2020 Bradley-Burns sales tax receipts. The CDTFA provides the calendar year results to the State Controller’s Office (SCO) and the SCO updates the pro-rata factor in June/July (previously, annual factors changed in March).

Impacts

Significant swings in the Bradley-Burns 1% sales tax could impact Proposition 172 fund allocations. Here are a couple of recent examples:

Pandemic Impacts. Changes in sales tax revenues during calendar year 2020, fueled by the intensity of the pandemic, have demonstrably impacted statewide allocations. Coastal, urban, metropolitan and tourist-dependent regions saw sales tax revenues decrease at a much larger rate than many inland and rural communities – thereby shifting the overall Bradley-Burns distribution of sales tax statewide.

Online Sales. Where a retailer is located and how it operates its business dictates how the local Bradley-Burns 1% portion of the base sales tax rate is allocated. For example, the pro-rata factor would be impacted if a large retailer changes its reporting so that some or all tax allocations shift from the countywide use tax pools (where all agencies receive a portion) to direct allocation (where a few agencies get a large portion).

Outlook

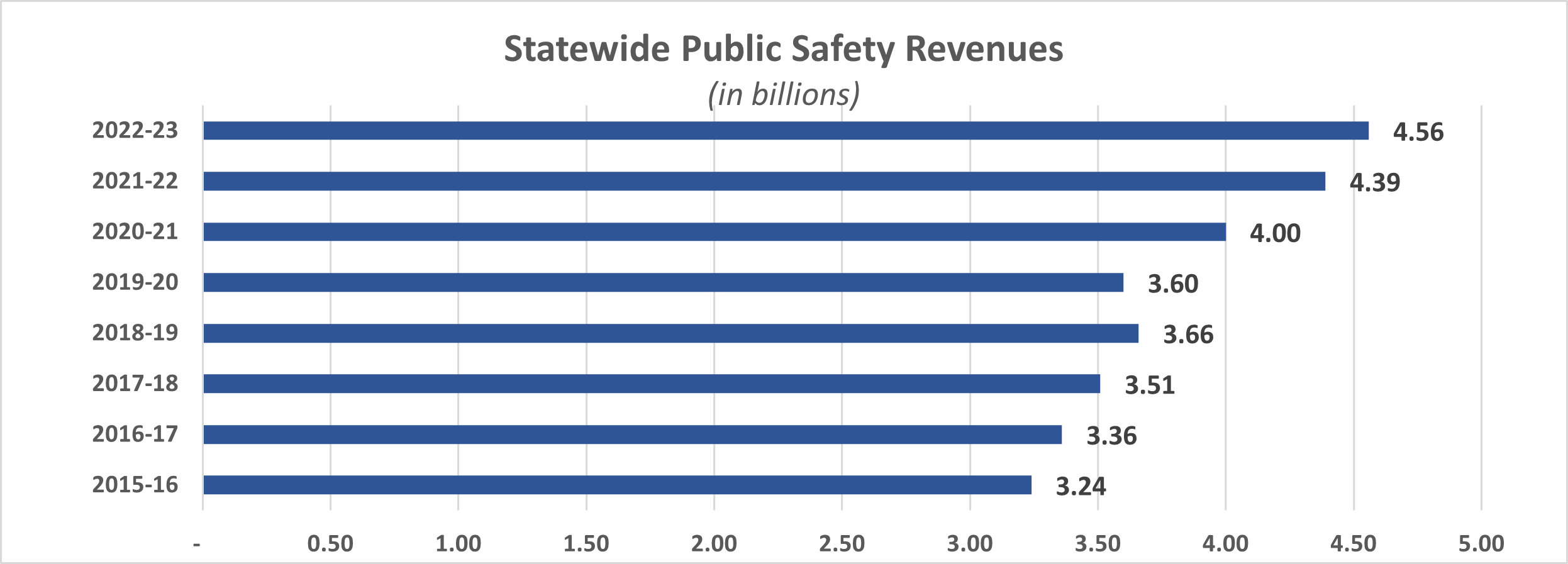

Even with factor changes, Proposition 172 revenues are estimated to grow as the California economy rebounds from the pandemic. As mentioned, the pandemic-infused 2020 sales tax performance greatly influenced FY 2021-22 Proposition 172 allocations. Separately, beginning in January 2021, a higher concentration of sales reported to agencies with in-state fulfillment centers will cause significant Proposition 172 factor changes for FY 2022-23.

Given expected statewide growth in Proposition 172 revenues for FY 2021-22 and FY 2022-23, per county results will vary widely. Counties (and cities therein) with large Proposition 172 tax fluctuations may wish to budget conservatively until the changes impacting the allocations begin to normalize.